15

In today’s digital age, mobile payment platforms have revolutionized the way we handle transactions. Among the leading players in this domain, Paytm stands out as a robust and versatile platform. In this comprehensive in this review, I’ll delve deep into its array of features, assessing my user experience, exploring its security measures, dissecting its pricing plans, and more.

Whether you’re a new user exploring the world of digital payments or an existing customer looking for a detailed analysis, this review aims to provide valuable insights into what payment platforms offers and how it can enhance your financial transactions.

Features Table

This feature table provides a snapshot of payment platforms’s key features and highlights its strengths in user experience, security, customer support, and pricing flexibility.

| Feature | Description |

|---|---|

| User Interface | 🖥️ Intuitive and user-friendly design |

| Features and Functionality | 💳 Payment options, bill payments, mobile recharges, and more |

| Payment Security | 🔒 Robust transaction security measures |

| Customer Support | 🛎️ Responsive customer service and feedback mechanisms |

| Security Measures | 🔐 Two-factor authentication (2FA) and data encryption |

| Pricing Plans | 💵 Subscription tiers and transaction fees |

| Download Now |

What is Paytm?

Paytm, which stands for “Pay Through Mobile,” has been my go-to mobile payment and financial services platform for years. Since its launch in 2010, payment platforms has evolved into a comprehensive digital ecosystem that caters to a wide range of needs. Whether I’m paying bills, recharging my mobile phone, booking tickets for movies or travel, or shopping online, Paytm has always provided me with a seamless and convenient experience through its user-friendly app.

One of payment platforms’s standout features is its versatility. I can easily transfer money to friends and family, pay utility bills like electricity, water, and gas, recharge my prepaid mobile numbers, and even handle services such as DTH television subscriptions. What’s more, Paytm ensures a secure platform for all my online purchases, allowing me to shop from a diverse selection of products across various categories.

User Interface and Experience

My experience with this payment platforms has shown me that its success is intricately woven into the fabric of its user-centric design philosophy. We have seen a profound understanding of the diverse tech proficiency levels among our user base. By crafting an intuitive user interface (UI), we have unlocked a gateway to inclusivity, welcoming users from all walks of life into a digital ecosystem that prioritizes simplicity without compromising on functionality.

At the core of our strength lies our clean and minimalist layout, meticulously curated to eliminate clutter and streamline the user journey. This strategic design choice not only enhances aesthetic appeal but also fosters a sense of trust and reliability, crucial elements in the realm of digital transactions.

Features and Functionality

Paytm offers a wide range of features and functionalities, including:

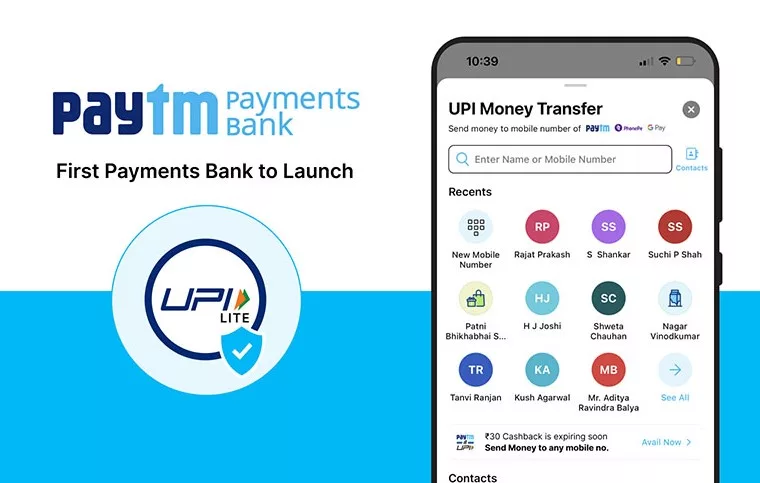

- UPI payments: Paytm integrates seamlessly with UPI (Unified Payments Interface), enabling instant and secure money transfers using your virtual payment address (VPA).

- Bill payments: Pay your mobile, electricity, water, and other bills conveniently within the app.

- Recharges: Top up your mobile balance, DTH subscription, and data plans with ease.

- Investments: Invest in mutual funds, stocks (through Paytm Money), and National Pension System (NPS) directly from the app.

- Travel bookings: Book flight tickets, bus tickets, and hotels through the app.

- In-store payments: Pay at partner stores using QR code scanning.

Payment Options and Transaction Security

Paytm provides a wide array of payment options, catering to the diverse needs of its users. Users can make payments using debit cards, credit cards, net banking, UPI, and Wallet balance. Additionally, it allows seamless integration with various payment gateways, making transactions convenient and hassle-free.

One of payment platforms’s standout features is its stringent transaction security protocols. The platform employs advanced encryption technologies to secure user data and financial information. Moreover, payment platforms implements multi-factor authentication (MFA) and biometric authentication, adding an extra layer of security to transactions. Users can also set up transaction limits and receive real-time alerts for enhanced security awareness.

Customer Support and Feedback

As someone who has extensively used Paytm, I can attest to its popularity and the diverse range of services it offers, from mobile recharges to bill payments and online shopping. When it comes to evaluating a service like Paytm, one of the key factors that significantly impacts the overall experience is its customer support and feedback mechanisms. Let’s take a closer look at how payment platforms handles customer support and gathers feedback.

In my experience, Paytm’s customer support has been impressive. They provide accessible, responsive, and knowledgeable support services that have helped me resolve any issues or queries efficiently. Additionally, payment platforms actively seeks and implements user feedback, which I believe is crucial for maintaining a user-centric approach and continuously improving their services. This proactive approach not only enhances the user experience but also contributes to maintaining high levels of customer satisfaction.

Security Measures

In today’s digital age, I believe that security is paramount, especially when it comes to financial transactions and personal data. one of leading digital payment platforms, places a strong emphasis on security measures to protect our users’ information and ensure a safe and secure experience.

Overall, our comprehensive approach to security, encompassing advanced technology, stringent authentication measures, proactive monitoring, and user education, contributes significantly to enhancing trust and confidence among our user base.

Pricing Plans and Options

I have personally found It provides a variety of basic functionalities at no cost to users. These functionalities include features like peer-to-peer money transfers, managing digital wallets, and making basic utility bill payments.

However, you may come across minimal charges for certain services such as bill payments and mobile recharges. These charges depend on the service provider and the type of transaction. this payment platform typically communicates these charges transparently to you before you confirm and finalize the transaction. This approach ensures clarity and convenience in managing your financial activities through the platform.

Final Words

I have found Paytm to be a versatile and user-centric platform that simplifies financial transactions and offers a host of services under one roof. Its intuitive interface, robust security measures, diverse features, and responsive customer support contribute to its popularity among millions of users like yourself.

If you found this article helpful and informative, consider sharing it with your family and friends on social media platforms such as Facebook and Twitter. Sharing valuable content can benefit others who may also find it useful in their endeavors.

The Good and The Bad

In the realm of mobile payment platforms, Paytm has garnered both acclaim and criticism. Let’s delve into the strengths and weaknesses of Paytm to provide a balanced perspective.

The Good

- User-friendly interface

- Diverse range of features

- Robust security measures

- Responsive customer support

- Cashback rewards and offers

The Bad

- Occasional customer service issues

- Limited investment options compared to dedicated investment platforms

Questions and Answers

Is Paytm safe to use?

Paytm implements security measures to protect user data. However, practicing safe online habits like keeping your login credentials secure is crucial.

Does Paytm have any charges?

Basic functionalities are free, but certain services might have minimal charges.

Is Paytm available internationally?

Currently, Paytm primarily caters to the Indian market.

You Might Be Interested In

Leave a Reply