29

In today’s fast-paced environment, I has found that effective management of one’s financial resources is absolutely necessary. Pocketguard and Rocket Money are two alternatives that are available to you when it comes to financial management systems. Both of these platforms have a variety of tools that may assist you in keeping track of your costs, creating an effective budget, and staying on top of your financial goals.

This post will provided you with a comprehensive comparison of Pocketguard and Rocket Money, with the goal of assisting you in determining which platform is the most suitable for your requirements.

Comparison Table

Being able to handle your own money better can depend on having the right tools. Pocketguard and Rocket Money are two well-known apps that can help you keep track of your money. Each has its own pros and cons. This table shows the main ways that Pocketguard and Rocket Money are alike and different. This way, you can choose the best one for your wants and preferences when it comes to money.

| Feature | Pocketguard | Rocket Money |

|---|---|---|

| Free Features | 📊 Budgeting tools, 💸 expense tracking, 📉 spending insights | 📊 Budgeting tools, 💸 expense tracking, 💳 bill finding |

| Paid Features | 💼 Advanced budgeting, 💰 bill negotiation, 🔒 identity theft protection (Premium Plus) | 💰 Bill negotiation, 🤵 concierge service, ⚠️ low balance alerts (Premium) |

| Budgeting Style | 🔄 Flexible (envelope or zero-based) | 🔄 Zero-based preferred |

| Bill Pay | ❌ No | ✅ Yes |

| Subscription Cost | 💵 $7.99/month (Premium), 💵 $9.99/month (Premium Plus) | 💵 $3-$12/month (Premium) |

| Visit website | Visit website |

User Interface and Experience

Pocketguard offers me an intuitive and user-friendly interface that simplifies the process of managing my finances. The app’s dashboard provides a clear overview of my income, expenses, and savings, making it easy for me to track my financial health at a glance.

On the other hand, Rocket Money boasts a modern design with easy navigation, ensuring a seamless user experience for budgeting and expense tracking tasks. You can quickly access key features and navigate between different sections, enhancing your overall experience with the app.

Features and Capabilities

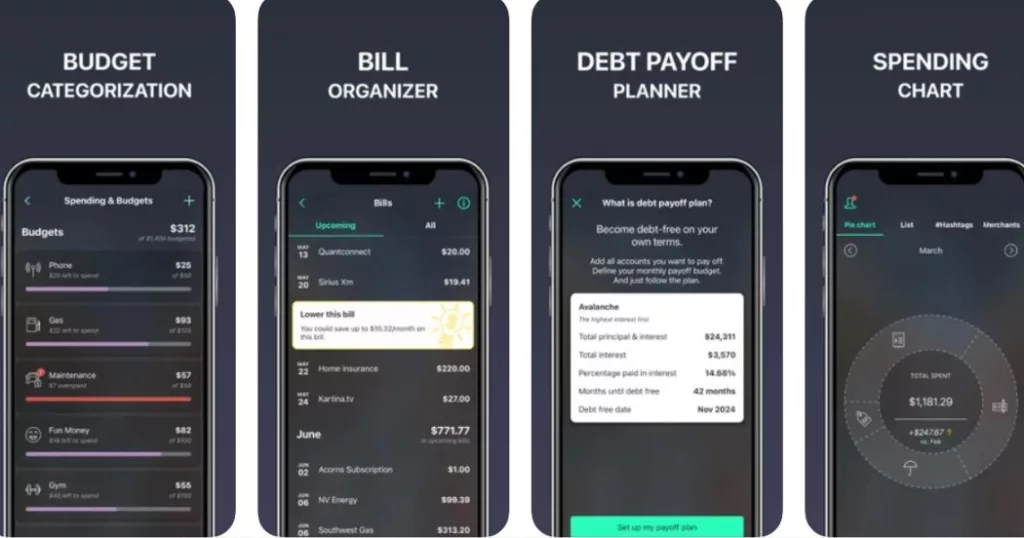

I have discovered that Pocketguard have powerful budgeting options, which include the ability to automatically categorise transactions, to create budget plans that are customisable, and to generate analytical reports. By utilising these capabilities, I am able to identify my spending patterns and identify specific areas in which I can save money in an effective manner.

Rocket Money, on the other hand, lays a greater emphasis on expense tracking and analysis. It offers extensive insights into trends in expenditures and provides techniques to efficiently optimise expenses using these insights. There is a possibility that it is the better option for you if you are seeking for a programme that will assist you in precisely managing your budget and keeping rigorous track of your expenses.

Budgeting and Expense Tracking

I like how Pocketguard automatically puts transactions into the right groups. This makes it easy for me to keep track of how much I’m spending. It gives me tips I can use to figure out how I spend my money and stick to my budget based on these areas. There are also tools in it, such as goal tracking, that help me make clear financial plans, such as paying off a bill or vacation savings. Aside from that, it lets me handle recurring costs, which helps me keep track of my bills and payments.

What Rocket Money does, on the other hand, is let users make their own budgets and estimates. You can make your own bills based on how much money you make, how much you spend, and your financial goals. You can make sure that your budget fits your wants and your budget when you have this much freedom. It also lets you set clear money goals and track your progress over time. You can see how your money is doing and stay on track to reach your goals.

Bill Payment and Management

From my experience, Rocket Money does a great job of integrating bill payments so that you don’t have to deal with handling multiple platforms. For your ease, Rocket Money lets you pay your bills right from the app, so you don’t have to switch between different platforms. Furthermore, the Premium version includes the low balance alerts tool that helps you keep track of your money by sending you useful alerts.

However, Pocketguard takes a different method by integrating with outside billers to make management easier. Even though it doesn’t let you pay bills directly from the app like Rocket Money does, the fact that it works with outside billers still makes handling bills easier.

Bank Integrations and Security

Security is the most important factor for me to consider when contrasting Pocketguard with Rocket Money. For the purpose of protecting my financial information, both applications make use of strong encryption technologies. It stands out from the competition due to its comprehensive interoperability with banks and other financial institutions.

This flexibility enables Pocketguard to provide real-time financial information and easy account connectivity. It is possible that Rocket Money has a slightly smaller network of supported banks and institutions, despite the fact that it also uses robust encryption techniques.

Customer Support and Reviews

Both Pocketguard and Rocket Money provide customer service via email and live chat, ensuring that you have access to help channels whenever you require it. My personal experience with It has been that its user-friendly layout and the flexibility it provides in terms of budgeting are both impressive. As a result, I find it simple to successfully manage my expenses.

Rocket Money, on the other hand, stands out due to its premium features, which include bill negotiation and concierge services. These features might be especially helpful for consumers who are looking for personalised financial guidance and optimisation.

Pricing Models

When I look at money-management apps like Pocketguard and Rocket Money, I think that Pocketguard is the best because it has a lot of different payment plans. People on a tight budget, like me, can use the platform because it starts with a free tier that has all the basic features. For people who want more advanced tools, Pocketguard has two paid plans, paid and Premium Plus. Both start at a reasonable $7.99 per month.

The free version of Rocket Money, on the other hand, is good for simple budgeting but lacks some features. It costs between $3 and $12 per month for Rocket Money users like me to get a premium subscription that gives us access to more features and customisation choices. The way the prices are set up lets users choose a plan that fits their needs and budget, making sure they get the right amount of service and features.

Which Platform is Right for You?

Your choice between Pocketguard and Rocket Money will rely on your personal needs and preferences when it comes to money. It might be a good choice for you if you like detailed budgeting tools, automatic categorization, and useful data. On the other hand, Rocket Money might be a better choice for you if you want flexible planning tools, strong bill payment features, and detailed tracking of your spending.

Feel free to share this post on Facebook and Twitter if you think it was a good read and could be of use to your friends and family. The act of sharing something of value increases the likelihood that other people will find it useful for their own purposes.

Pocketguard: The Good and The Bad

Pocketguard is a popular app for managing personal finances that makes planning and keeping track of spending easier for users. This app has both good and bad points, like all apps. In this part, we’ll talk about the good things about Pocketguard and the bad things that could be better, so that potential users can get a full picture.

The Good

- User-friendly interface with clear visuals

- Flexible budgeting options (envelope & zero-based)

- Valuable “Find Money” feature to identify savings opportunities

The Bad

- No built-in bill pay functionality

- Free tier lacks advanced budgeting features

Rocket Money: The Good and The Bad

Rocket Money is an app for managing your money that has a lot of features to make planning, keeping track of expenses, and managing your bills easier. Like any other app, it has some good points and some places that could use some work. This part will talk about Rocket Money’s strengths (the good) and areas where it could use some growth (the bad), giving people who are thinking about using this platform a full picture.

The Good

- Streamlined bill pay and management

- Automatic bill negotiation with concierge service (Premium only)

- Free tier offers basic budgeting tools

The Bad

- Less flexible budgeting compared to Pocketguard

- Free tier has limited features, pushing users towards premium plans

Questions and Answers

Is Pocketguard or Rocket Money more secure?

Both applications place a high priority on data encryption for security. Pocketguard, on the other hand, interfaces with a wider variety of financial institutions, which may allow it to provide coverage that is more comprehensive.

Can I use Pocketguard or Rocket Money for free?

It is true that both provide free tiers that include fundamental budgeting capabilities. However, the free tier of Pocketguard is typically considered to have a higher level of functionality.

When it comes to paying off debt, which app is superior?

As part of its premium subscription, Pocketguard provides a debt payback option for its customers. However, Rocket Money’s automatic bill management can free up cash flow that can be used for debt repayment, despite the fact that it does not have a dedicated feature.

You Might Be Interested In

Leave a Reply