60

Welcome to our in-depth study of MoneyLion! Many parts of this banking platform will be carefully looks into, such as its features, how easy it is to use, security measures, price plans, and more. Because we want you to make an informed choice about whether or not MoneyLion meets your preferences and needs when it comes to your finances, we want to give you all the information you need.

Want an app for your phone that can help you manage your money, get cash quickly, and even raise your credit score? Money Lion might be the key. Many tools in this fintech app are meant to help people like me take better care of our money. But does it fit me well? This detailed review of MoneyLion will tell me everything I need to know about the service, including how to use it, what it offers, how much it costs, and how good the customer service is.

MoneyLion review: Feature Table

This part of the MoneyLion review will show you a thorough table of features that highlights the most important parts of what MoneyLion has to offer. This table can help you quickly understand the most important features and functions that MoneyLion offers. Let’s look at the many features that MoneyLion has to offer today!

| Feature | Description |

|---|---|

| Instacash 💸 | Get cash advances up to $250 without a credit check |

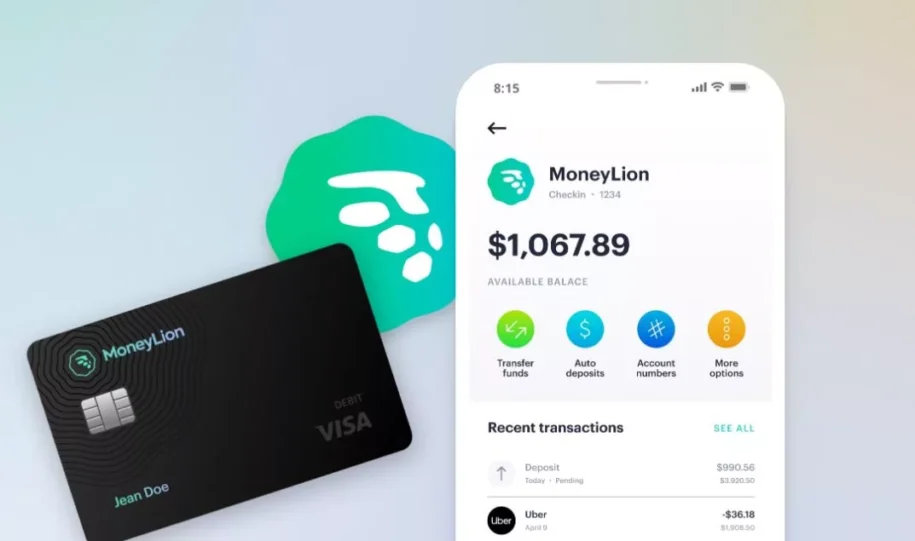

| RoarMoney 🦁 | Free mobile checking account with budgeting tools |

| Credit Builder Loan 🏦 | Small loan that helps build credit score |

| Investment Account 📈 | Invest in stocks and ETFs with no account minimums |

| Visit website |

What is MoneyLion?

I was able to look into it thanks to MoneyLion, and I have to say that it has been quite a journey. Through this site, you can get a lot of different services, such as banking, investing, and building credit. Making this happen is meant to give you the tools and information you need to take care of your money and reach your goal level of financial success.

MoneyLion review: User Interface and Experience

I can state from personal experience that the MoneyLion app has a user-friendly layout that is specifically intended for easier navigation and better accessibility. I can say this because I have used the app myself.

Because of this streamlined design, I was able to rapidly access a wide range of capabilities, which enabled me to effectively monitor my financial well-being and make well-informed decisions regarding the techniques I use to manage my finances. As you use the MoneyLion app, you will discover that it is meant to simplify and simplify the process of managing your finances overall.

MoneyLion review: Features Offered

MoneyLion provides its users with a variety of services that serve the purpose of assisting them in efficiently managing their funds. The following is a list of MoneyLion’s most important features:

- Cashback Rewards: Earn cashback on everyday purchases and boost your savings.

- Investment Options: Access investment opportunities and grow your wealth with personalized portfolios.

- Credit Building Tools: Improve your credit score with tailored recommendations and credit monitoring.

- Financial Tracking: Track your spending, set budgets, and receive insights to achieve financial goals.

- Borrowing Options: Get access to loans and credit lines tailored to your financial situation.

MoneyLion review: Financial Tools and Services

From what I’ve seen, managing personal funds in the digital age requires trustworthy tools and services that can meet a range of financial needs. MoneyLion has been very helpful in giving us a complete financial platform with many options that are specifically designed to help us reach our financial goals. Let’s look at MoneyLion’s most important services and features:

- Savings and Checking Accounts

- Investment Portfolios

- Credit Monitoring and Building Tools

- Personal Loans and Credit Lines

- Financial Tracking and Budgeting Tools

MoneyLion review: User Reviews and Ratings

A pleasant experience has been had by me with MoneyLion, and I am grateful for the many services it provided, the user-friendly interface it provides, and the personalised financial counsel it provides. When it comes to meeting our financial requirements, many of us believe that the services offered by MoneyLion, such as Instacash, RoarMoney, Credit Builder Loan, and Investment Account, are helpful.

However, there is a possibility that you will have app difficulties on occasion, such as delays in updates or loading times. Additionally, during peak periods, the response times for customer care may be longer.

MoneyLion review: Security Measures

MoneyLion cares about safety above all else to keep your information and activities safe. Strong safety measures, like encryption, are used to keep private information from getting into the wrong hands. We also use two-factor authentication (2FA), which makes you show two different kinds of ID before you can get into your account. This is an extra security step. These steps help make sure that no one else can get in even if they know your password.

We also have strict ways of making sure people are who they say they are. These rules make sure that when you open an account and make certain deals, you are who you say you are. This adds another level of security against scams. Because we use encryption, two-factor authentication (2FA), and name verification, you can be sure that your money is safe with us.

MoneyLion review: Customer Support Experience

At MoneyLion, we place a high priority on delivering great customer care by offering you a variety of special channels through which you may receive assistance. These channels include in-app chat, email support, and phone support. Because of this dedication to accessibility, you will always be able to simply get in touch with someone for assistance anytime you require it.

Users have repeatedly provided us with favourable comments regarding their experiences with our support services, highlighting the timeliness and helpfulness of our call centre representatives. You have a high level of overall happiness and trust in our platform, which is largely contributed to by the fact that we provide help that is both professional and efficient.

MoneyLion review: Pricing Plans and Membership Tiers

We offer a free basic membership at MoneyLion that lets us use RoarMoney and a number of other tools. When I chose the premium membership, on the other hand, I got a lot of extra perks. Some of these were higher limits for Instacash, which let me get cash advances fast. As a premium user, I could also access tools that let me keep an eye on my credit score.

These helped me keep track of and improve my credit health over time. In addition, the premium membership gave me access to features related to investment accounts, which let me look for investment possibilities and build my portfolio. It is important to know that the premium membership costs money every month, while the standard membership is free. The premium membership is a good choice for people who want complete financial tools and support from MoneyLion because it comes with more perks and services that are designed to help you on your financial journey.

Final Words

At MoneyLion, we offer you a full set of financial tools and services to help you handle your money more effectively. MoneyLion is a good choice for people who want to handle all of their money well because it has an easy-to-use interface, personalised help, and strong security features.

If you found this article helpful and informative, consider sharing it with your family and friends on social media platforms such as Facebook and Twitter. Sharing valuable content can benefit others who may also find it useful in their endeavors.

MoneyLion review: The Good and The Bad

We’ll talk about the pros (“The Good”) and cons (“The Bad”) of using MoneyLion as a financial platform in this part of the study. You can decide if MoneyLion is the right choice for your financial needs if you know both sides. Let’s jump right in!

The Good

- Comprehensive financial services

- User-friendly interface

- Personalized financial guidance

- Robust security measures

The Bad

- Occasional app glitches reported

- Some users mention delays in customer support response times

Questions and Answers

Is it safe to use MoneyLion?

The answer is that MoneyLion protects your financial data by utilising security techniques that are customary in the industry.

Does MoneyLion do a hard credit check?

To answer your question, MoneyLion does not conduct a thorough credit check for features such as Instacash advances.

Is MoneyLion worth it?

Your requirements will determine whether or not MoneyLion is a wise investment. It is possible that the membership cost is reasonable if you require access to Instacash advances and tools for developing credit. On the other hand, if you only require fundamental capability, other

You Might Be Interested In

Leave a Reply