43

According to my observations, in the fast-paced and ever-changing company world of today, efficient financial management and streamlins corporate procedures are absolutely necessary for achieving success. In my experience, businesses frequently rely on specialised platforms such as Bill.com and Ramp to simplify complicated processes that are associats with the administration of expenses, the creation of invoices, and the processing of payment workflows.

In this in-depth comparison, we will examine the most important features and advantages of both Bill.com and Ramp, which will enable you to make an educated selection that is tailored to the specific needs of your business.

Comparison Table

Before we get into the specifics, let’s take a brief glance at a comparison chart that highlights the most important distinctions between Ramp and Bill.com:

| Feature | Bill.com | Ramp |

|---|---|---|

| Focus | 💵 Accounts Payable Automation | 🏢 Corporate Spend Management |

| Payment Methods | 💳 ACH, Check, Virtual Cards | 🏦 Corporate Cards, ACH, Check |

| Expense Tracking | 📉 Limited | 📊 Robust, Real-time |

| Integrations | 🔄 Popular Accounting Software (QuickBooks, Xero) | 📚 Accounting Software, Payroll Platforms |

| User Interface | 🌐 Web-based | 📱 Modern, Mobile-friendly |

| Visit website | Visit website |

User Interface and Ease of Use

Thanks to our time at Bill.com, we know that the easy-to-use interface makes many things much easier, like handling invoices, making payments, and keeping track of costs. This platform’s layout has made it easy for us to move around, which has cut down on the time it takes for new users like you to learn how it works.

For example, Ramp focuses on making cost reporting easier and gives you real-time information about how your money is being spent. This makes your experience better by giving you quick access to important information, which is a big plus. These two platforms were both made to help businesses be more efficient and make managing their money easy.

Integrations and Compatibility

Some of the most famous accounting software, customer relationship management (CRM) platforms, and other business tools are all fully integrated with Bill.com. We can easily sync data, automate tasks, and centralise financial operations on a single platform thanks to this wide range of connection options. Bill.com gives us a complete ecosystem that makes our general workflow more efficient, whether it’s syncing invoices with accounting systems or combining payment processing with CRM solutions.

Ramp, on the other hand, makes sure that big platforms that are important to business operations work well together. This includes connecting to financial software, tools for keeping track of expenses, and other important platforms. Ramp lets us handle all of our financial tasks from one place by making it easy for data to move between these systems. This centralised approach not only makes it easier to track and reconcile our expenses, but it also gives us more control and visibility over how much our business spends.

Key Features

At Bill.com, we’ve found that our key features really make the billing process easier. With our automated invoicing feature, we don’t have to do as much work by hand because invoices are made and sent instantly, saving us time and making sure they are correct. Also, our flexible payment approvals let us set up specific rules and processes for authorising payments, which gives us more control and makes sure we’re following the rules.

On the other hand, Ramp’s ability to track spending in real time has surprised us. We can keep an eye on our spending as it happens and see right away where our money is going. We’ve been able to make smart choices and keep track of our budget better thanks to this real-time visibility. Ramp also gives us useful information about our spending by looking at our spending habits to find trends and ways to make things better. Ramp’s proactive messages have been especially helpful because they let us know about possible ways to save money and help us make smart financial decisions that make the best use of our resources.

Use Cases and Target Audience

Many types of businesses use Bill.com, from small start-ups to large corporations. This is why it’s an important part of my business. It can be used for many things because it can be scaled up or down. For example, it can be used to manage money by keeping track of things like bills, accounts payable, and accounts due. It’s a great tool for all kinds of businesses, including mine, because it has powerful features like digital approvals, automated processes, and easy integration with accounting software.

In the same way, Ramp has helped us keep better track of our spending. It’s a good fit for our need for low-cost solutions because it’s geared towards startups, small and medium-sized businesses, and mid-sized companies. Thanks to its easy-to-use interface, ability to handle employee cards, and real-time insights into spending trends, Ramp has made our experience very efficient and effective. Ramp is a great choice for companies that want to better control their costs without giving up usability or usefulness.

Customer Support and Reviews

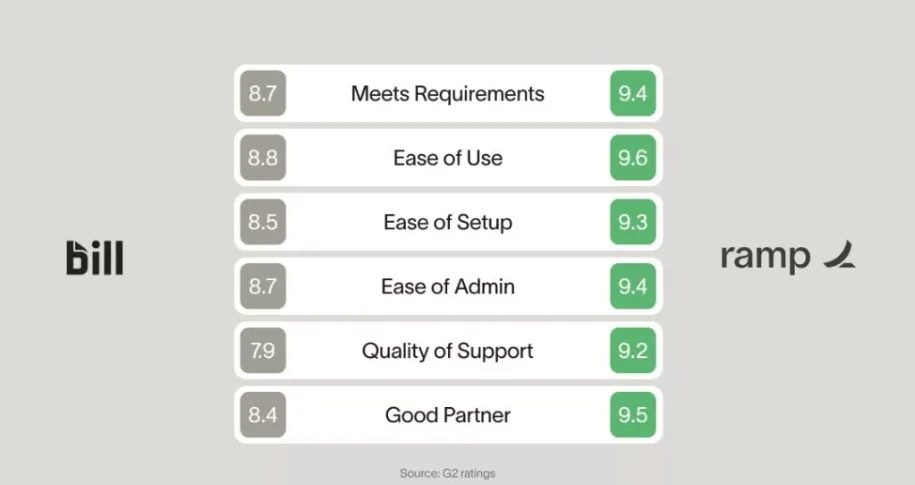

I’ve seen that both Bill.com and Ramp put a lot of effort into making sure their customers are happy by offering quick and helpful customer service. From my own experience with Bill.com, I can speak to the quality of their dedicated help, which has received good reviews from users. Quick and helpful answers have made it a lot easier to deal with any problems or questions that come up.

But with Ramp, I’ve found that even though the number of users is growing, they still provide great help. They make sure that user questions are answered quickly and correctly, which has greatly improved my experience with their website. Ramp’s support services are trusted and relied on because they are dedicated to meeting users’ needs quickly.

Security and Compliance

Both Bill.com and Ramp put a lot of emphasis on security, and we’ve seen that they take strong steps to keep private financial information safe and make sure transactions are safe. From what I’ve seen, Bill.com’s security planed includes using strong encryption to keep data safe while it’s being sent and while it’s being stored. Multi-factor authentication (MFA) adds an extra layer of security by asking users to prove who they are using more than one thing, like a password, biometrics, or a security token.

In addition to these steps, Bill.com follows data security rules and standards set by the business, such as SOC 2 compliance. This keeps a high level of trust and confidence among users and partners like you by making sure that our systems and processes meet strict security standards.

Pricing Plans and Value Proposition

Bill.com has different price plans for businesses of different sizes and needs. Our deals are full of features to make sure you get the most for your money. These plans are made to fit the needs of your business, whether you’re in charge of billing, collecting payments, or managing accounts due. Because our prices are flexible, you can pick the plan that fits your budget and business needs. This makes Bill.com a flexible choice for managing your money.

At Ramp, on the other hand, we use an open pricing plan that focuses on saving you money and giving you a clear return on investment (ROI). We make it easy for you to understand the costs and benefits of using our platform by giving you clear price information that doesn’t include any hidden fees or complicated structures. This openness not only helps you plan your budget, but it also lets you see how using Ramp directly affects your bottom line. This makes us a trusted choice for companies like yours that want to save money and work more efficiently.

What’s the Best Platform for You?

When it comes to having to decide between Bill.com and Ramp, my choice is determined by the precise business requirements I have, the budgetary constraints I have, and the scalability requirements I have. For the purpose of making an educated choice, I would perform an analysis of the features, integrations, customer support, and security measures offered by each platform.

If you found this article helpful and informative, consider sharing it with your family and friends on social media platforms such as Facebook and Twitter. Sharing valuable content can benefit others who may also find it useful in their endeavors.

Bill.com: The Good and The Bad

Bill.com is a complete platform for managing finances that works for firms of all sizes, from small start-ups to big companies. It has many features that make billing, making payments, and keeping track of expenses easier. This part will talk about the pros (the good things) and cons (the possible bad things) of using Bill.com for your business’s money matters.

The Good

- Intuitive interface,

- Extensive integrations,

- Automated invoicing.

The Bad

- Pricing may be higher for some businesses

- Limited to financial management functions

Ramp: The Good and The Bad

Ramp is a modern tool for managing expenses that helps startups, small and medium-sized businesses (SMBs), and mid-sized businesses run more smoothly. Its new features and easy-to-use design make it a popular choice among businesses that want to track expenses efficiently and find ways to save money. We’ll talk about the pros (the good) and cons (the possible bad) of using Ramp to handle your business’s money in this part.

The Good

- User-friendly design,

- Real-time spend tracking,

- Cost-saving insights.

The Bad

- Targeted primarily at startups and SMBs

- May lack advanced enterprise features.

Questions and Answers

Can Bill.com handle complex invoicing and payment workflows?

Bill.com does, in fact, include automated invoicing, payment approvals that may be customised, and powerful reporting features, all of which are designed to facilitate the effective management of complex financial procedures.

Is Ramp suitable for large enterprises with extensive financial management needs?

With its real-time expenditure tracking, expense insights, and extensive reporting tools, Ramp is able to scale to suit larger enterprises, despite the fact that its primary target audience is small and medium-sized firms (in other words, startups).

How does customer support compare between Bill.com and Ramp?

Both systems offer responsive customer support, with Bill.com providing personalised assistance and garnering positive evaluations for its service. Ramp, on the other hand, ensures that support is provided in a timely manner and successfully addresses user inquiries.

You Might Be Interested In

Leave a Reply