1

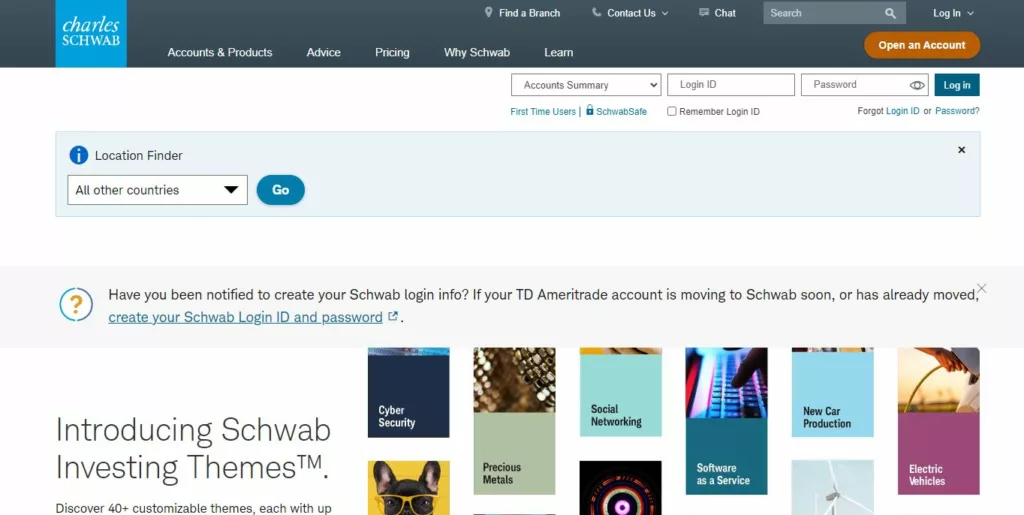

There are a lot of tools and resources that buyers can get from both Charles Schwab and Fidelity. These include trade platforms, advanced study tools, low fees, great customer service, and a lot of investment choices. Because I’ve worked with both of these companies, I can say for sure that they are both great. There are also lots of business chances with both groups.

Your buying habits, trade preferences, and other individual criteria are only a few of the many potential determinants of your choice. It is recommended to explore the many services offered by each platform before committing to one. Several things must be considered throughout this process, such as the price, investment opportunities, platform use, and customer support.

Charles Schwab vs Fidelity: Comparison Table

“First, let’s look at Charles Schwab and Fidelity side by side, focusing on important factors such as fees, investment options, customer service, and more.” A brief comparison of the two systems is given in this table.

| Feature | Charles Schwab | Fidelity |

|---|---|---|

| Account Minimum | $0 💵 | $0 💵 |

| Stock & ETF Trades | $0 commission-free 📈 | $0 commission-free 📈 |

| Options Fees | $0.65 per contract 💸 | $0.65 per contract 💸 |

| Mutual Fund Trades | No-transaction-fee options 🔄 | No-transaction-fee options 🔄 |

| Margin Rates | Start at 13.3% 🔒 | Start at 12.075% 🔒 |

| Account Fees | May apply for certain features ⚠️ | No account fees ✅ |

| Visit website | Visit website |

Charles schwab vs Fidelity: User Experience and Interface

The structure and ease of use of a brokerage tool have a big impact on how I handle my finances, as I have seen firsthand. Platforms like Charles Schwab and Fidelity stand out because they work hard to make their systems simple and easy to use. This makes it simpler to find your way around and keep your money in order.

You can leave a mark on me with the simple viewing tools, advanced mobile apps, and full account management choices that Charles Schwab and Fidelity offer. What makes a big difference in how well and quickly my investments have gone? It doesn’t matter how good of an investor I am.

Charles schwab vs Fidelity: Performance Analysis Tools

It is very good to know how well different assets have done in the past so that you can make smart choices and adjust your holdings as required. I have used both Charles Schwab and Fidelity, and I can say that they both have very good tools for keeping track of success. These tools make it simple for those like me to keep an eye on our investments and figure out what they mean.

When investors use these performance analysis tools, they can find out a lot about how their investments are doing. This helps them spot trends and take advantage of chances. This method is based on facts and helps people make smart decisions that will help their stocks do better and help them reach their financial goals faster.

Charles schwab vs Fidelity: Integrations and Third-Party Services

Building in third-party services is a key part of making the banking world better for everyone. In order to link with many different financial tools, tax software, and investment management systems, both Charles Schwab and Trust know how important this is. This is meant to make it simple to handle and share data.

Integration with third-party services improves buying by giving clients a complete picture of their money, making tax preparation easier, and giving them specific investment advice. This is something that both Charles Schwab and Fidelity want their clients to know and be able to do with their money. This method can help you reach that goal.

Charles schwab vs Fidelity: Low-Cost Index Funds

Schwab has some index funds that don’t cost much. One of them is the Schwab S&P 500 Index Fund (SWPPX). Another is the Schwab Total Stock Market Index Fund (SWTSX). To do as well as the S&P 500 and the Total Stock Market Index, these funds’ main goal is to do well. People can buy a lot of American stocks with these things.

Funds for low costs can be bought from Fidelity. The Fidelity Total Market Index Fund (FSKAX) and the Fidelity 500 Index Fund (FXAIX). The goal for these funds is to do as well as the S&P 500 and the Total Market Index. Money can be put into a lot of different companies and fields.

Charles schwab vs Fidelity: Investor Preferences

Each investor has their own likes, goals, and financial objectives based on what they have learned. Many people know and trust both Charles Schwab and Fidelity as banks. They offer a wide range of services and goods to meet the specific needs of each customer. They make solutions just for you that use both active and passive financial strategies. This makes sure that you handle your money in a full way.

Along with ways to spend, both Charles Schwab and Fidelity offer a wide range of tools for planning your future. These tools give owners the knowledge they need to protect their retirement savings in a smart way. For example, they tell owners how to divide their assets, deal with risk, and plan their income. There are a lot of different options for these systems, so investors can choose whether they want to be involved directly or have things done for them automatically.

Charles schwab vs Fidelity: Security Features

People who shop online need to keep their accounts and personal information safe, so safety is very important. As someone who has worked at both Charles Schwab and Fidelity, I can say that they take a lot of strict steps to make sure their customers are safe.

There are a lot of different ways that Charles Schwab and Fidelity secure the data that customers send between their systems and their devices. This security keeps information safe and makes sure that people who shouldn’t see it can’t see it when you share it, like passphrases or bank information.

Charles schwab vs Fidelity: Customer Feedback

I used Charles Schwab when I first started saving, and I must say that it worked great. Even someone like me who has never used a site before could figure it out. Also, they had great customer service. They were always there to help me and explain things in a way I could understand whenever I had a question, which was often at first.

Fidelity is what I use now that I’m a more skilled trader. Their tools for study are great! The fact that I can learn a lot about any stock I’m thinking about makes me feel good about my choices. Their fees are also very low, which means I can keep more of my hard-earned money.

Charles schwab vs Fidelity: Fee Structures and Pricing Plans

Both let you buy stocks and ETFs without any fees, which makes them good for people who are tight on cash. If you trade on debt a lot or have a lot of money in your account, this makes Fidelity a better deal for you. When you take money from a broker to buy stocks, they charge you interest. This is known as borrowing rates. When you borrow money, you pay less interest when market rates are low.

They don’t charge account fees either, which can help you save even more on your savings if you have a big account. You can trade on both sites for free, but Fidelity may be a better choice for some buyers.

Which Is Superior?

That’s how it feels when you choose a trader like Fidelity or Charles Schwab. There are tools, weights, and a place to sweat at both clubs. What you want to do will determine the best choice for you. Which of Charles Schwab and Fidelity you pick will rely on your top priorities, financial goals, and personal tastes. How safe the site is, how much it costs, and what it can do for you are all things you should think about when making your choice.

Consider sharing this article on social media platforms such as Facebook and Twitter if you found it to be informative and thought-provoking for your acquaintances and loved ones. Sharing a valuable item increases the probability that an additional individual will discover it to be beneficial for their own objectives.

Charles Schwab: The Good and The Bad

A lot of people stick with Charles Schwab, who is a well-known name in the world of savings. But is it sunny and bright everywhere? Let’s look at the good, the bad, and the bottom line when it comes to Charles Schwab.

The Good

- Wide range of investment options

- Low-cost index funds

- Robust performance analysis tools

- Excellent customer support

The Bad

- Higher fees for certain services

Fidelity: The Good and The Bad

This part will talk about the good and bad things about Fidelity as a trading tool. People who are looking for an investment company can learn more about Fidelity by reading this piece. It speaks to both the pros and cons of the company.

The Good

- Comprehensive investment options

- Competitive fees and pricing

- Strong security features

- Educational resources

The Bad

- Limited international trading options

Questions and Answers

Which platform is better for active traders?

Charles Schwab and Fidelity both have advanced trading systems and tools that busy traders can use. Fees, trading choices, and study tools are some of the things you should think about when choosing a trading site.

Do Charles Schwab and Fidelity offer retirement planning services?

Charles Schwab and Fidelity both have advanced trading systems and tools that busy traders can use. Fees, trading choices, and study tools are some of the things you should think about when choosing a trading site.

What are the margin rates and account fees for Charles Schwab and Fidelity?

Charles Schwab: Margin rates are different for each type of account, and there may be fees.

Fidelity: Margin rates are different for each type of account, and there may be account fees.

You Might Be Interested In

Leave a Reply