26

These days, it’s tough to keep track of money, but it’s more important than ever. When I use cutting edge apps like Wally, it makes this process a lot easier. It has a lot of features, such as planning tools, the ability to track expenses, insights and analysis, the ability to track bills, making goals, security measures, pricing plans, and more. Let me talk about my experience with it. After reading this, you’ll have a good idea of whether Wally is the right money tool for you.

Wally is unique because it is very simple to use. It helps me manage my money well and keep track of what I spend. Its planning tools have helped me set goals for my money, keep track of what I spend on different things, and learn more about how I spend my money. I can also keep track of my money better with this app because it automatically records all of my activities when I spend money.

Features Table

To fully understand what Wally can do as a financial management app, you need to look into all of its main features in depth. This table of features gives a short but useful summary of what Wally has to offer.

| Feature | Description |

|---|---|

| Account Aggregation | ???? Connects to your bank accounts for a holistic view of your finances. |

| Budgeting Tools | ???? Set custom budgets and track progress towards your financial goals. |

| Expense Tracking | ???? Automatically categorize transactions and analyze spending habits. |

| Insights and Analysis | ???? Gain valuable insights into your spending patterns through reports and visualizations. |

| Bill Tracking & Reminders | ⏰ Stay on top of your bills with due date notifications and payment reminders. |

| Goal Setting | ???? Define and track your financial goals for motivation and accountability. |

| Security | ???? Employs industry-standard security measures to protect your financial data. |

| Visit website |

What is Wally App?

“I think Wally is a great choice for anyone who wants to easily handle their money.” The goal is to make it simple to keep track of your spending, income, and goals. You can use it as a person or as a business owner. Its features are made to make your money tasks easier and give you useful information about your money. A lot of people can use it since it works on both iOS and Android.

User Experience and Interface

The user interface that Wally provides is an extraordinarily user-friendly one, which I find to be of great assistance. By making it simple to navigate and allowing for the input of data in a short amount of time, it is intended to simplify financial tasks for users such as yourself and me.

Its uncluttered style and user-friendly interface make it an excellent choice for individuals who are just starting out in the field of financial management. It makes it simple to create budgets and keep track of costs. My appreciation goes out to Wally for the way it offers its most important functions in a format that is simple to comprehend, which makes it simple to learn and make efficient use of its resources.

Budgeting Tools and Strategies

Wally gave me a lot of power by giving me strong planning tools and advice that are tailored to my specific financial situation. Being able to make my own budgets based on my income, spending, and financial goals is one of my favourite features. With this customisation, I can easily set goals that are attainable and keep track of my progress.

One great thing about Wally is that it gives you real-time information on how your budget is doing. I got instant alerts and messages when I spend too much, which helps me stay on track and make smart financial decisions. By giving me information about my spending habits and patterns, it helps me find ways to save money and make my spending more efficient. It’s like having a small personal budget manager in my pocket!

Expense Tracking and Management

When I use Wally, I find that keeping track of my costs becomes a really simple and straightforward process. Through the use of this application, I am able to effortlessly organise my expenditures into categories, attach receipts for future reference, and easily monitor my spending patterns.

There is one aspect of Wally that truly jumps out, and that is its sophisticated algorithms, which provide me with profound insights into the direction in which my money is heading. This function gives me the ability to make educated judgements regarding my finances and to alter my spending habits in accordance with those decisions.

Insights and Analysis

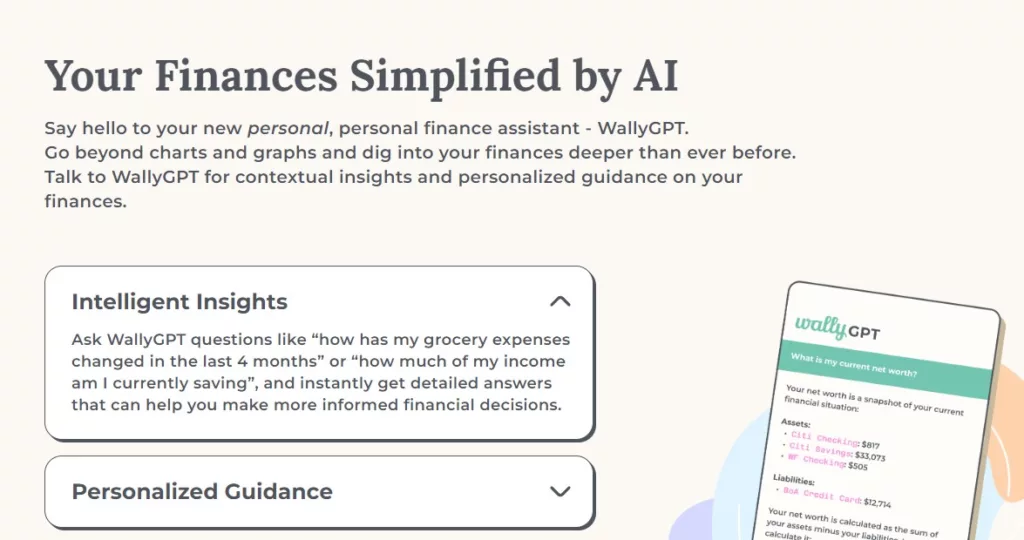

Thanks to Wally, the way I handle my money has changed a lot that I’m glad for. It gives you more than just the ability to keep track of your spending because it gives you insights and information. You can see your financial information more clearly by using charts, graphs, and reports. This makes it easier to spot patterns, areas that need work, and chances to save or spend.

Giving yourself this much information lets you make smart choices about your money, set reasonable goals, and keep track of your progress over time. its full-featured research tools give you useful information that goes beyond just keeping track of your expenses. You can use them to look at your spending patterns, make the most of your budget, or plan for the future.

Bill Tracking and Payment Reminders

Wally’s tool that tracks bills and sends payment reminders makes it easy to keep up with our financial obligations. You can make sure you never miss a bill payment date again by setting up reminders. This proactive method can help you better manage your cash flow and stay away from late fees and penalties that can hurt your financial health.

Wally lets you keep track of payment due dates, which gives you a good picture of your upcoming financial obligations. You can easily keep track of when your bills are due, which lets you plan your spending and set aside money to pay your bills on time. This helps keep things in check so there aren’t any last-minute rushes or mistakes that could cause financial stress.

Goal Setting and Achievement

With Wally’s goal-setting tool, it’s easy and accurate to reach your financial goals. It makes it easy to set clear goals, track your progress, and celebrate important steps along the way, whether you’re saving for a dream trip, paying off debt, or building up an emergency fund.

Wally’s tools for keeping track of your goals not only give you a clear picture of your financial goals, but they also keep you motivated and responsible. You can stay focused and determined to reach your financial goals if you picture yourself making progress and staying on track.

Security and Privacy Measures

Security is very important when it comes to banking information, and Wally knows this well. At every step, we put your privacy and safety first. Your private data is safe with us because we use strong encryption methods to keep it safe while it’s being sent and stored. Along with that, we use secure cloud storage solutions to keep your info in a very safe place.

Another important part of our protection plan is authentication. Depending on what your device can do, we use strong authentication methods like biometric authentication or multi-factor authentication (MFA). These extra steps make sure that only you, as the authorised user, can get to the app and your banking information.

Pricing Plans and Options

Wally’s pricing is set up so that it can meet the wants of a lot of different customers. From my own experience, I know that the free basic version has all the tools you need to make a budget and keep track of your spending. This includes features like putting costs into groups, attaching receipts, and showing how people spend their money.

You can get more advanced tools and features with its paid plans, which give you access to more features. Some of these might be advanced analytics, which let you look into your financial info in more depth and learn useful things. With the custom reporting features, you can make reports that are unique to your financial wants and goals. Plus, if you have special customer support, you can get help and advice right away whenever you need it or have questions.

Final Words

Overall, I think Wally is a great tool for managing money because it has a lot of useful features, such as easy-to-use interfaces, planning tools, tracking expenses, insightful analyses, and strong security measures. It has a full set of tools that can be customised to fit your needs, whether you’re an individual trying to improve your money habits or a business that needs to make managing your money easier.

Feel free to share this post on Facebook and Twitter if you think it was a good read and could be of use to your friends and family. The act of sharing something of value increases the likelihood that other people will find it useful for their own purposes.

The Good and The Bad

When evaluating any app for managing finances, such as Wally, it is essential to consider both the app’s merits and the areas in which it might be improved. As we look further into what makes it shine, let’s also examine the areas in which it may use some polishing.

The Good

- Intuitive user interface

- Robust budgeting and expense tracking tools

- Detailed insights and analysis

- Secure and privacy-focused

- Flexible pricing plans

The Bad

- Some advanced features restricted to premium plans

- Occasional syncing issues reported by users

Questions and Answers

Does Wally have a version that is compatible with both iOS and Android?

Indeed, Wally can be downloaded on both the iOS and Android platforms, making it accessible to a significantly larger number of users.

Does Wally offer customer support for its users?

Yes, Wally does offer customer support services, and users who have subscribed to premium programmes are eligible to receive priority support through the company.

Can I sync Wally with my bank accounts for automatic transaction tracking?

Yes, Wally gives users the ability to synchronise their bank accounts in order to keep track of their transactions automatically and to receive real-time notifications on their income and expenses

You Might Be Interested In

Leave a Reply