1

You should make sure the investing sites you pick will help you reach your financial goals before you buy anything. That’s why I’m going to talk about how I used Acorns and Stash, two apps that help users in different ways. What are their main features? How easy are they to use? How well do they work? How good is their customer service? What about their mobile apps? How much do they cost? What are their pros and cons?

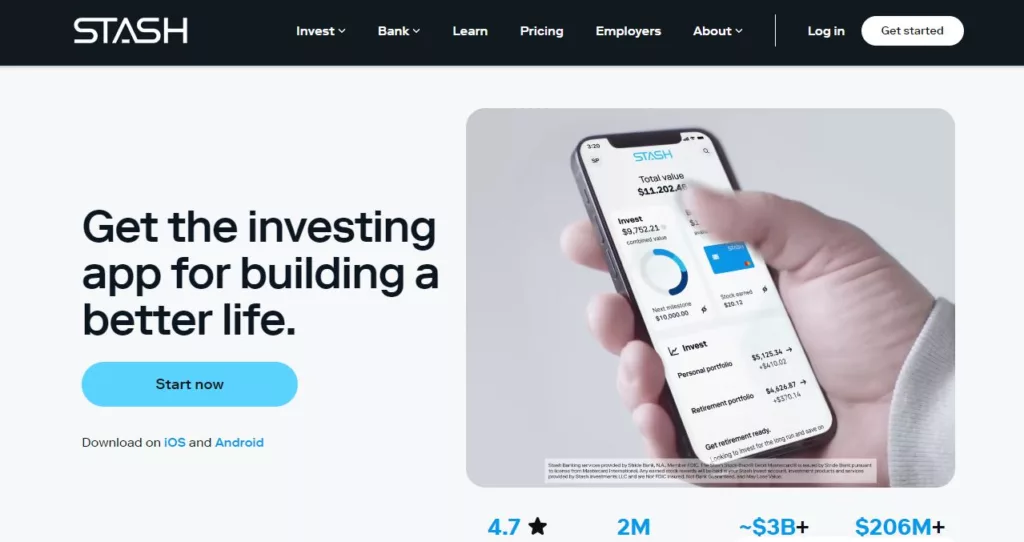

As far as I can tell, both Acorns and Stash has great mobile apps for banks. Acorns is great for micro-investing because it adds up the money I spend on everyday things, which lets me spend extra change. Stash, on the other hand, is simple enough that I can start investing in stocks and ETFs with just $5.

Acorns vs Stash: Comparison Table

To begin, let’s investigate the similarities and differences between Acorns and Stash by examining the following table:

| Aspect | Acorns | Stash |

|---|---|---|

| User Experience | 🔄 Simplified and automated investing | 📘 Educational approach to investing |

| Features | 💰 Round-up investments, portfolios | 🌱 Fractional shares, themed investments |

| Performance | 📊 Diversified portfolios, moderate returns | 🚀 Long-term growth potential |

| Customer Service | 📧 Email support, in-app assistance | 💬 Live chat, phone support |

| Mobile App | 📱 User-friendly, account management | 📚 Educational content, investment tracking |

| Customer Support | ℹ️ Knowledge base, FAQs, community | 🛡️ Personalized support, security features |

| Pricing Details | 💵 Monthly fee based on account type | 💳 Monthly fee, add-ons for premium features |

| Visit website | Visit website |

Acorns vs Stash: User Experience and Interface

I’ve saved money with both Acorns and Stash. They’re both good for different people because of their own benefits. From what I seen, Acorns makes saving simple and automatic, which is great if you’d rather not handle your own funds. The simple layout of my portfolio makes it easy for me to make regular purchases, collect gifts, and keep an eye on how it’s doing. Anyone can make their money grow over time with this simple plan.

The approach to Stash, on the other hand, is more educational, which I like. Its goal is to give user like me information and educational material that will help us learn more about investing. Stash gives users a lot of educational tools, like papers, videos, and personalised tips, to help them make smart financial choices. This focus on teaching is great for people like me who want to learn more about investing and manage our accounts in a more natural way.

Acorns vs Stash: Features and Benefits

When it comes to saving apps like Acorns and Stash, the round-up investments tool in Acorns really changes the game for me. It rounds up the money I spend every day to the nearest dollar and invests the extra. This makes it easy to save money and watch my investments grow over time. This, along with Acorns’ diverse funds that are tailored to my level of comfort with risk, gives me a well-rounded investment plan that perfectly fits my financial goals.

Stash, on the other hand, stands out because it has partial shares, which let me buy expensive stocks with very little money. This makes investing more accessible to everyone, so I can build a varied portfolio even though I started with a small amount of money. I also like Stash’s themed investments because they let me put my money into areas or themes that I care about, like technology, environment, or healthcare. I like how this makes my business plan more personal and fits with my values and hobbies.

Acorns vs Stash: Performance Comparison

My strategy with Acorns is based on diverse portfolios that are meant to get moderate yields while lowering risk through diversity. As part of this plan, I’ll split my purchases across different types of assets, like stocks, bonds, and real estate. By spreading out my investments, I hope to lessen the effect that changes in the market have on the general success of my portfolio. This method works especially well for investors like me who want a good balance between growth possibility and risk control.

You can get long-term growth potential from Stash, though. It does this by giving me a lot of investment options based on my preferences and how much risk I’m willing to take. These are things like stocks, exchange-traded funds (ETFs), and theme portfolios that are put together based on ideas or topics. You can make your own business plan with Stash. It works for my financial goals, whether they are to make money, grow my money, or do a mix of the two.

Acorns vs Stash: Customer Service

I’ve found that Acorns and Stash are different when it comes to customer service and protection features. Acorns’ main ways of helping customers are through chat and help within the app. You can also use our knowledge base and frequently asked questions (FAQs) to find answers to common questions and figure out problems on your own. This method to self-help can be helpful if you like to solve problems on your own or have general questions that don’t need instant help.

Instead, Stash focuses on personalised help and gives you the choice of live chat and phone assistance. By doing this, you can talk to our customer service reps directly and get help right away. You can get personalised help with financial plans and account management, or you can solve complicated problems. This gives you more hands-on experience when you need it.

Acorns vs Stash: Mobile App Comparison

The focus on providing a smooth and easy user experience through the mobile app is something I like about Acorns. The app makes it easy for me to handle my account, keep track of my finances, and see how my portfolio is doing by focusing on simplicity and automation. Acorns makes it easy for me to keep track of my money and make smart choices about my investments with its clean and easy-to-use layout and navigation.

Stash’s mobile app, on the other hand, does more than just handle accounts; it also has a lot of teaching resources and tools. The goal of these tools is to give users like you the information and ideas you need to make smart business decisions. The Stash app has a lot of useful information for people who want to learn more about personal finance and investment strategies. It has articles, videos, and engaging tools that can help you evaluate risk and spread out your investments.

Acorns vs Stash: Customer Support and Security

Acorns has many ways for customers to get help, such as a large knowledge base, a forum for open discussion, and a list of commonly asked questions (FAQs). You can talk to other people in the Acorns group and find answers to popular questions in this forum. This setup has been put in place to make sure that you can easily get information and help. It also makes the user experience better.

If you’re looking for personalised customer service, on the other hand, look no further than Stash. Our help staff is dedicated to answering your specific questions and solving your problems. This personalised method gives you an extra level of safety because you will be able to get personalised help whenever you need it.

Acorns vs Stash: Pricing Details

Upon examination of the charge structure of Acorns, I am able to identify two primary plans: Acorns Lite, which costs $3 per month, and Acorns Personal, which costs $5 per month. Through these programmes, I am able to have access to automatic investment, donations that are rounded up, and fundamental instruments for financial education. With Acorns Personal, I am able to take advantage of extra services such as access to a broad portfolio of exchange-traded funds (ETFs) and retirement account alternatives.

Stash, on the other hand, has plan options beginning at $3 per month for its Stash Beginner plan. This plan includes access to fractional shares, a personal investing account, and financial education. When I choose to go with the Stash Growth plan, which costs $9 a month, I am able to gain access to more advanced services such as a Stock-Back debit card, which provides me with stock incentives whenever I make purchases at selected stores.

Which option is superior?

You can pick between Acorns and Stash based on your spending habits, how much risk you are willing to take, and what you want to achieve with your money. For someone like me who doesn’t want to touch their money, Acorns has been a good choice. For people like me who are new to saving, Stash has been helpful. It’s also good for people who want to make themed investments and use their teaching tools to learn more about investing.

If this post has been both educational and enjoyable for you, share it with your friends and family.

Stash: The Good and The Bad

Stash’s best features are its focus on education, its partial shares, its themed investments, its live chat help, and its strong security measures. But its regular fees and extra costs may be a turnoff for some users.

The Good

- Flexibility with stock picking

- Educational tools

- Stock-Back debit card

The Bad

- Higher fees than Acorns’ basic plan

- Limited ETF selection compared to Acorns

Acorns: The Good and The Bad

Acorns is great at automated investing, round-up investments, diverse portfolios, an app that is easy to use, and average profits. But users should think about the regular fees and the fact that they might not be able to spend in all kinds of things.

The Good

- Completely automated investing

- Round-ups make saving effortless

- Lower fees

The Bad

- Less control over investments

- No fractional share investing

Questions and Answers

Can I switch between Acorns and Stash?

Sure, you are able to move your assets from one platform to another; but, before making the transition, you should think about any costs or tax ramifications that may arise.

When it comes to long-term investment, are Acorns and Stash appropriate options?

Each platform provides investment opportunities that are appropriate for long-term objectives; nonetheless, it is vital to examine their portfolios and performance in order to ensure that they are in line with your investment plan.

How do I contact customer support for Acorns and Stash?

Stash provides retirement investment alternatives through its website, whereas Acorns offers retirement accounts similar to individual retirement accounts (IRAs).

You Might Be Interested In

Leave a Reply