45

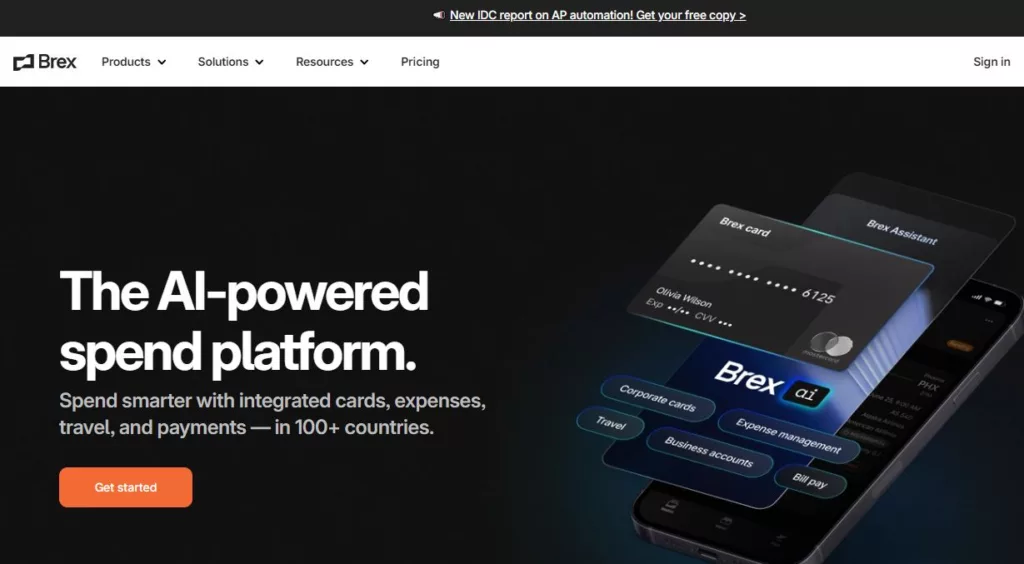

I see Brex as a tool that works well for new businesses and ones that are growing, like mine. One great thing about Brex is how well it works with other accounting and business software modules. This makes it easy to manage data and speeds up our job in general. Brex also has some great benefits, like corporate cards with great rewards, credit lines that work with our business, and automated cost categorization that saves us time from having to do it by hand.

Another option is Expensify, which I’ve used a lot because it’s easy to use and lets me change almost everything. It works well for all kinds of companies, from small start-ups to big ones like ours. Expensify stands out because it has powerful features for scanning receipts, advanced approval processes, and tracking expenses in real time. These features give us correct information about our finances and make sure we follow the rules.

Comparison Table

To begin, let’s create a comparison table that provides a concise summary of the most important features and functionalities that Brex and Expensify have to offer:

| Feature | Brex | Expensify |

|---|---|---|

| Core Offering | 🏢 Corporate credit card with expense management | 💼 Expense management software |

| Ideal User | 🚀 Startups, high-growth companies | 📊 Businesses of all sizes |

| User Interface | 🖥️ Streamlined, focused on key financial data | 🎨 Comprehensive, feature-rich |

| Expense Tracking | 📸 Automatic receipt capture, AI-powered coding | 📝 Manual or automatic receipt capture, coding |

| Reporting | 📊 Real-time, customizable reports | 📈 Customizable reports with various filters |

| Integrations | 🔄 Limited integrations (accounting optional) | 🛠️ Integrates with popular accounting software |

| Mobile App Functionality | 📱 Full-featured mobile app for expense tracking | 📲 Full-featured mobile app for expense tracking |

| Visit website | Visit website |

Features and Capabilities Comparison

Based on what I know about both Brex and Expensify, I think that Brex’s sleek and modern design makes it stand out. It puts an emphasis on easy navigation so that users like you can quickly get to the most important features. The dashboard, which shows all of your spending, credit card use, and other useful financial information, is a good example of how the design focuses on making the user experience smooth.

Expensify, on the other hand, focuses on being easy to use by having a simple layout that makes managing expenses simple. It’s great at things like making it easy to submit expenses, scanning receipts quickly, and making the review process go smoothly. With these features, Expensify is a great choice for companies like yours that want to keep their expense tracking simple and quick.

Expense Tracking and Reporting

In my current situation, the automated receipt matching feature that Brex offers has proven to be of great assistance. The process of tracking and classifying expenses is simplified as a result of this, which makes the management of financial resources for enterprises significantly easier. Brex removes the need for manual data entry and reduces the number of errors that occur, which eventually results in a significant amount of time and resources being saved. This is accomplished by automatically matching receipts with the transactions that relate to them.

Expensify, on the other hand, is the best way for me to keep track of my spending in real time. The system lets businesses keep track of their money transfers as they happen in real time. Businesses like yours can be sure that they can got accurate and up-to-date financial information because of these real-time features. When you use Expensify, you can make choices based on correct information and know exactly how much you’re spending at all times.

Integrations with Accounting Software

Brex and Expensify both have add-ons that work with popular bookkeeping programmes like NetSuite, QuickBooks, and Xero. These connections are very important for making sure that the processes of syncing and reconciling data go smoothly. We make it easier to send financial data by connecting straight to these accounting platforms. This makes sure that reporting is accurate and quick.

This saves companies a lot of time and cuts down on the mistakes that can happen when data is entered or moved between systems by hand. The integrations make it possible for financial data to be updated and synced in real time. This means that teams can use the most up-to-date data for planning, tracking expenses, and financial analysis. Not only does this level of automation boost efficiency, but it also makes financial reporting more accurate and reliable, which is important for making smart decisions and following the rules.

Mobile App Functionality

Brex and Expensify are both great mobile apps for both iOS and Android devices when it comes to how they work. I’ve found that Brex’s mobile app is a great way to keep track of credit card usage, manage costs, and get financial updates while you’re on the go. It’s easy to use, and the features make it simple to organise expenses, make budgets, and make thorough reports.

Expensify’s mobile app, on the other hand, stands out to me because it is easy to use and manages processes well. I’ve found it very easy to take pictures of receipts with my phone, so I don’t have to enter the information by hand. Expensify’s approval workflows also make sure that handling expense jobs is easy and safe from anywhere, making it easy and flexible to manage expenses from afar.

Security and Data Privacy Measures

We put security first at Brex by using encryption methods used by banks. This technology is meant to keep private financial information from people who shouldn’t have access to it. It also protects your data while it’s being sent and stored. This makes it less likely that someone will get into your information without your permission, so you can rest easy knowing that it is safe.

Expensify, on the other hand, is proud to be SOC 2 Type II compliant. With this certification, you can be sure that we follow strict rules for data protection, availability, processing integrity, privacy, and secrecy. It is especially important for users who value strong data security and need to know that their financial and personal information is safe that this compliance certification is issued.

Pricing Plans and Value Proposition

From what I’ve seen, Brex has flexible price plans that are made to fit the needs of businesses like mine. This customised method makes sure I get exactly what I need without having to pay extra for features I don’t need, which gives me the most for my money. Because of this, Brex gives me the freedom to make my spending management work better for my specific needs and workflows.

Not so with Expensify. Their price is based on subscriptions, and they have different levels of service that meet the needs of different users like you. Businesses, whether they are small startups or big companies, can choose a plan that fits their needs and budget with this structured method. Expensify focuses on providing complete solutions that make managing expenses easier and give useful financial information. These solutions include scanning receipts, keeping track of expenses, and tools for making reports.

What’s the Best Platform for You?

To choose between Brex and Expensify as an expense tracking platform, I’ve found that it comes down to what’s most important to my business. Among features like automatic matching of receipts and real-time spending details, Brex tends to stand out as the best choice. On the other hand, Expensify is usually the better choice for me if I put a lot of value on advanced reporting tools and smooth integrations with financial software.

Feel free to share this post on Facebook and Twitter if you think it was a good read and could be of use to your friends and family. The act of sharing something of value increases the likelihood that other people will find it useful for their own purposes.

Expensify: The Good and The Bad

Expensify is a renowned expense management software that has gained popularity for its advanced features and user-friendly interface. In this section, we will explore the strengths (the good) and weaknesses (the bad) of Expensify, helping you understand what makes it a standout solution and where it may fall short for certain users.

The Good

- Advanced reporting capabilities

- Customizable approval workflows

- Seamless integrations with accounting software

The Bad

- Subscription-based pricing model

- Limited customization options for smaller businesses

Brex: The Good and The Bad

The premier expenditure management tool for startups, e-commerce, and life sciences organisations is Brex. Its features ease expense tracking, provide real-time spending insights, and improve financial control. In this section, we’ll examine Brex’s pros and cons, explaining why many organisations choose it and where it may have drawbacks. Brex’s value proposition and areas for improvement can be found by examining its strengths and limitations.

The Good

- Automated receipt matching

- Real-time spending insights

- Customized pricing plans

The Bad

- May not be suitable for larger enterprises with complex financial needs

Questions and Answers

Can Brex handle large-scale expense management?

In response to your question, Brex is excellent for startups, firms involved in e-commerce, and corporations in the health sciences industry; however, larger businesses that have more sophisticated financial demands may require extra customisation.

Does Expensify offer 24/7 customer support?

Yes, Expensify offers support via chat and email around the clock, ensuring that users receive timely assistance whenever they need it.

Which platform makes the most sense from a financial standpoint for small businesses?

Although Brex and Expensify both provide good value for the money, the customised pricing plans offered by Brex may be more cost-effective for small enterprises, depending on the requirements that come with their particular situation.

You Might Be Interested In

Leave a Reply