48

Effective expense management is an essential skill for companies of any size to possess in this day and age of digital technology. Additionally, it helps to streamline operations and increase productivity, in addition to contributing to the maintenance of a healthy financial situation.

I am able to share insights about the features, user experience, target audience, pricing, and other aspects of both Expensify and Bill.com, which will assist you in making an informed decision due to the fact that I have used both of these services for cost management.

Comparison Table

With Expensify and Bill.com, you can easily keep track of your expenses and automate your finances. Let us look at a thorough table comparison to see what makes them different and what their strengths are.

| Feature | Expensify | Bill.com |

|---|---|---|

| Focus | 💼 Expense management, reporting | 💳 Accounts payable (AP), accounts receivable (AR) |

| Target Audience | 🏢 Businesses of all sizes | 🚀 SMBs (Small and Medium Businesses) |

| Ease of Use | 🌟 Very user-friendly, intuitive interface | 🔄 User-friendly, but slightly more complex |

| Expense Tracking | 📊 Excellent, with automated receipt capture | 📈 Good, but lacks advanced expense tracking |

| Reporting | 📊 Robust reporting with customization options | 📉 Good reporting for AP and AR |

| Integrations | 🔄 Integrates with popular accounting software | 🔄 Integrates with major accounting software |

| Mobile App | 📱 Excellent mobile app with offline functionality | 📱 Good mobile app with basic functionalities |

| Visit website | Visit website |

User Interface and Ease of Use

I like how simple the Expensify website is to use since I use it. It’s simple for me to file my papers and keep track of my money. It is easy to get to important features, like putting expenses into groups and making reports, thanks to the style. This makes controlling expenses faster overall. I like how easy it is to switch between areas. This helps me manage costs and keep an eye on them in real time.

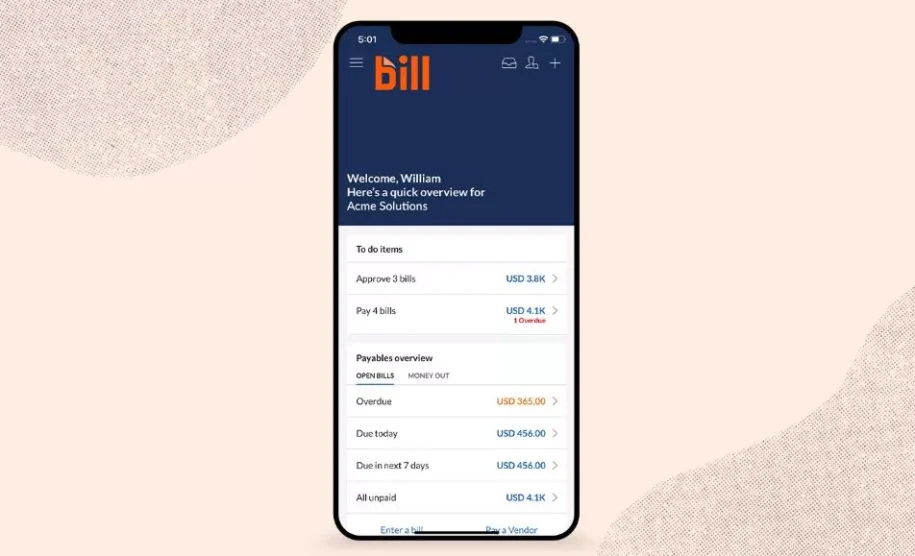

Bill.com, on the other hand, has a clean and well-organized layout that focuses on making it easy to track invoices and make payments. I can easily make, review, and accept bills because they are designed to be clear and simple. It’s easy to work with the platform and find my way around it, which helps me manage providers, set up payment plans, and file financial reports.

Target Audience Comparison

I can say from personal experience that Expensify is designed to meet the needs of small to medium-sized businesses like ours that need useful tools for keeping track of and reporting costs. The system can do things like scan receipts, automatically classify expenses, give you real-time information on your spending, and let you change the way approvals work.

As an alternative, Bill.com serves a bigger range of clients, such as small businesses, large businesses, and other types of businesses. The company’s main goals are to provide solutions for managing invoices and handling payments, as well as to streamline processes like paying vendors, getting invoices approved, and automating accounts payable.

Features and Capabilities

One thing that makes Expensify stand out is how well it keeps track of spending and scans papers quickly and correctly. We can get useful real-time details about our money activities from it. It has a complicated tool that lets us make reports that are just right for us and our needs. See how we spend our money in full. This helps us make smart choices about our money.

However, Bill.com stands out because it has many useful tools for handling invoices, such as a set of tools that make writing invoices simpler and faster. With Bill.com’s advanced automation features, companies don’t have to do as much work by hand. This saves them time and money and makes sure they’re following the rules. Its in-depth data also teach us a lot about managing money, like how to improve cash flow, keep track of payment statuses, and find cost-cutting opportunities.

Expense Tracking and Reporting

When I use Expensify, it keeps track of my spending very well and gives me the most up-to-date information on what I “spend.” With this feature, I can keep an eye on costs as they change, making sure that all of my financial transactions are recorded properly and on time. The reporting tools in Expensify are also very useful. I can make thorough summaries of my spending, put my spending habits into groups, and look at long-term trends.

I can make smart financial decisions with the help of these reporting tools because they show me where to cut costs, change the budget, and make long-term plans. But I like that Bill.com has all the tools I need to keep track of my spending, like thorough spending reports and analytics tools. With these tools, I can look into my financial information in more depth and find useful information that helps me do a full financial analysis.

It’s easy to keep track of my spending with Bill.com because it gives me customisable dashboards and reports that I can use to see how my money is doing and look at spending trends. This level of analysis and detail helps me make decisions based on facts, lower costs, and improve the general efficiency of my money management.

Integrations with Accounting Software

We promise that our software will work seamlessly with the most popular accounting software, so businesses can easily sync their data and keep their work flowing. Our connections make it easy for our platform and accounting software to talk to each other and share data. This means that you don’t have to enter data by hand, which lowers the chance of making mistakes.

We make it easier for businesses like ours to keep track of their money by integrating smoothly with famous accounting programmes like QuickBooks, Xero, and FreshBooks. This improves accuracy and saves time. It’s easy for us to import and export financial data like bills, payments, costs, and more. This keeps our accounting records correct and up to date.

Mobile App Support and User Experience

Based on my experience, Expensify’s mobile app is a complete way to keep track of receipts and costs. From my phone, it’s easy to take pictures of receipts, sort costs into categories, and make expense reports. Tracking expenses is easy and quick with this app’s powerful features and easy-to-use interface, making it great for both people and businesses.

On the other hand, I’ve found that Bill.com’s mobile app is better at making the process of handling invoices and making payments faster. It’s made to handle bills, keep track of payment statuses, and make it easy to pay on smartphones or tablets. This focus on invoice management and payment features makes the whole user experience better by making important financial tasks easy to access. This lets businesses handle their money well from anywhere.

Pricing Plans and Value for Money

My observations have shown that both Expensify and Bill.com provide price plans that are based on subscriptions and are designed to cater to the various requirements of organisations. At Expensify, we use a tiered pricing structure, which gives consumers the flexibility to select a plan that is tailored to their particular needs and budgetary constraints.

On the other hand, Bill.com goes one step further by offering individualised plans that are able to scale along with the expansion of customers’ businesses. This guarantees that businesses such as ours receive value for our money by allowing us to pay depending on our usage and the capabilities that we require, without spending an excessive amount of money on aspects that are not necessary. It doesn’t matter if you’re a small startup looking for cost-effective expense management or a huge organisation in need of complete financial solutions; both Expensify and Bill.com offer price options that are tailored to different business sizes and needs.

What’s the Best Platform for You?

When it comes to picking between Expensify and Bill.com, it depends on what our business needs. If we want to make tracking and reporting expenses as easy as possible, I think Expensify is the best option. Bill.com, on the other hand, has all the financial management tools we need if our main goal is to handle our invoices and payments.

If you found this article helpful and informative, consider sharing it with your family and friends on social media platforms such as Facebook and Twitter. Sharing valuable content can benefit others who may also find it useful in their endeavors.

Expensify: The Good and The Bad

Expensify’s best features are its ability to handle receipts, track expenses in real time, and make reports that fit your needs. However, its price and advanced features may be too much for some users to handle.

The Good

- User-friendly interface and mobile app.

- Powerful expense tracking and reporting features.

- Strong corporate card integration.

The Bad

- Subscription pricing can become expensive for large teams.

- Lacks advanced features

Bill.com: The Good and The Bad

Bill.com is great at processing invoices, automating payments, and giving you thorough analytics. However, new users may find its interface hard to understand, and some functions may require more expensive subscriptions.

The Good

- Streamlines accounts payable and receivable processes.

- Offers online bill payment and invoice approval workflows.

- Freemium model with affordable add-ons for

The Bad

- Reporting may not be suitable for advanced needs

- Less feature-rich mobile app compared to Expensify

Questions and Answers

Can Expensify integrate with my existing accounting software?

There is no doubt that Expensify provides smooth connections with common accounting platforms, which guarantees the synchronisation of data and the efficiency of operations.

Does Bill.com support international payments?

The answer is yes; Bill.com is able to process foreign payments, giving businesses the ability to conduct transactions on a worldwide scale.

Which platform offers better mobile app support?

In order to facilitate expenditure and financial management while on the move, both Expensify and Bill.com offer comprehensive mobile applications with containing crucial functionality.

You Might Be Interested In

Leave a Reply