31

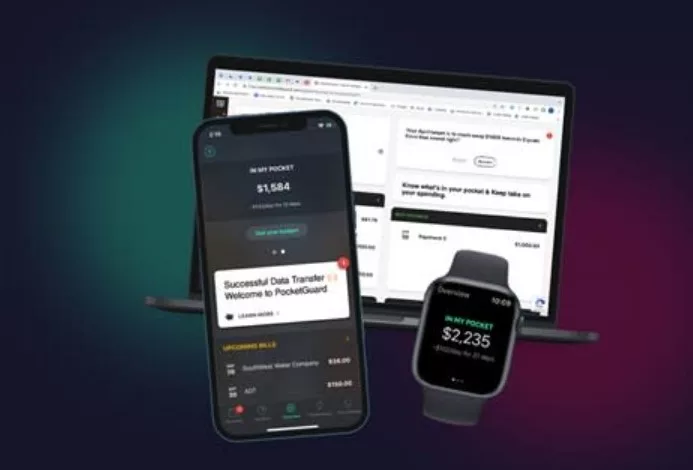

My own experience have taught me that in today’s fast-paced digital environment, it is of the utmost importance to be able to navigate finances in an expedient manner. It has been my experience that the utilisation of budgeting applications such as PocketGuard has been of great assistance to me in streamlining this procedure. PocketGuard is a comprehensive platform that enables me to monitor my expenditures, handle my payments, examine my spending trends, and do much more.

For the purpose of gaining a better grasp of the value of PocketGuard, let’s take a more in-depth look at its features, user experience, security measures, pricing, as well as its advantage and disadvantage.

Features Table

Before getting into the specifics of PocketGuard’s features, it’s good to get a sense of what the app can do. In this part, we’ll show you a short table of PocketGuard’s main features. This table will be useful for people who want to quickly see what the app can do. Let’s take a closer look at its features.

| Feature | Description |

|---|---|

| In My Pocket 💰 | Tracks bills and goals to display real-time spendable cash. |

| Automatic Transaction Categorization 🔄 | Saves time by automatically sorting your transactions. |

| Bill Tracking & Management 📅 | Keeps track of upcoming bills and due dates. |

| Spending Analysis & Insights 📊 | Provides categorized breakdowns of your spending habits. |

| Subscription Tracking 🔍 | Identifies recurring subscriptions and helps manage them. |

| Bill Negotiation (Premium) 💳 | Connects you with services to potentially lower your bills. |

| Visit website |

What is PocketGuard Budgeting App?

It’s really helped me get my spending under control, and a lot of other people do the same. It checks my stocks, credit cards, loans, and bank accounts to see how my money is doing right now. PocketGuard’s powerful features and easy-to-use interface are meant to make handling money easier for everyone, from individuals to families. A lot of this has helped me stick to my goals to buy things and save money.

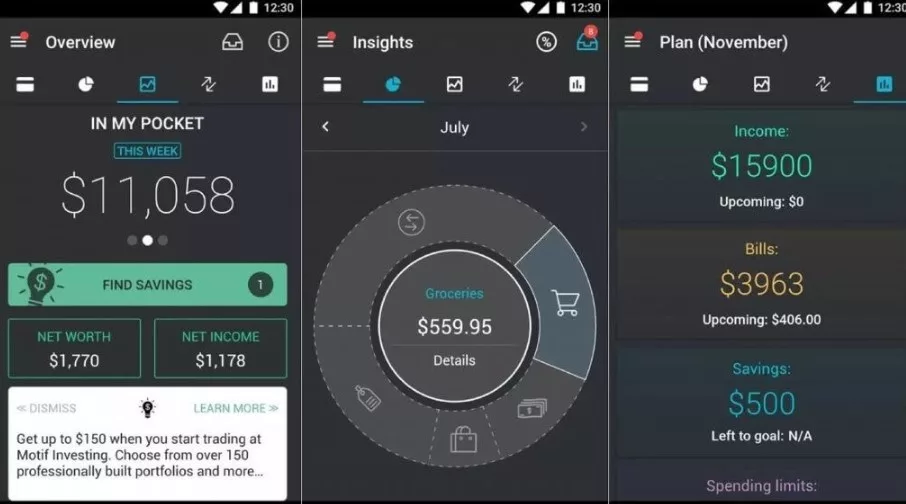

User Experience and Interface

The easy-to-use design of PocketGuard is a real breakthrough. The app stands out from others that helped me handle my money because it shows my money data in a nice-looking way with simple graphs and charts that I can understand. I can quickly see how much I’m spending, keep track of my savings goals, and get a general idea of my financial health thanks to this.

With PocketGuard, it’s easy for me to get to the different parts, like purchases, budgets, and bills. Users with no technology knowledge will able to easily understand and use the app’s features because the interface is made to be easy on the eyes. The interface of PocketGuard makes it easy to do things like managing your bills, looking at your recent activities, or setting up budgets.

Budgeting Tools and Strategies

Through the use of PocketGuard, I have discovered a comprehensive set of budgeting tools that gives me the ability to successfully handle my many financial matters. I have the ability to effortlessly define spending restrictions across a wide range of areas, including food, entertainment, utilities, and more, and I can modify budgets to correspond with my income and the goals I have set for my finances.

Real-time tracking of expenses against these predefined restrictions is made possible by the platform, which provides me with the opportunity to obtain useful insights into my spending patterns. Particularly noteworthy is the fact that PocketGuard’s proactive warning system warns me if I am getting close to or over the boundaries that I have established for my budget. This helps me cultivate a proactive mindset towards responsible spending and healthy saving habits.

Bill Tracking and Management

It can be hard to keep track of all your bills when you have to remember so many due dates and amounts. On the other hand, PocketGuard makes this process easier by keeping all of my bills in one place that is simple to find. I can link my regular bills like taxes, payments, loans, and so on to the PocketGuard app. Combining these two things saves me time and helps me keep track of my bills and tasks.

One of the best things about using PocketGuard to keep track of your bills is that it can remind you of them. You’ll never miss a payment due date because the app tells you of them at the right time. This method not only keeps you from having to pay late fees, but it also helps you better plan and save your money. PocketGuard makes it easy to see all of your bills and when they’re due. This lets you choose when and how to spend your money, which will protect your finances and give you peace of mind in the long run.

Spending Analysis and Insights

When it comes to budgeting, having a clear understanding of where my money is going is absolutely necessary, and PocketGuard excels in this particular area. PocketGuard provides me with a full perspective of my financial situation by analysing my spending patterns, classifying transactions, and creating relevant reports.

Not only do these reports point out places in which I might be spending more than I should, but they also point out prospective areas in which I could wind up saving money. Having access to this information gives me the ability to make well-informed decisions regarding my finances and to take concrete efforts to improve my financial habits. PocketGuard makes it possible for me to manage my finances in a way that involves not just keeping track of my expenditures but also receiving vital insights that will help me reach my financial objectives.

Subscription Tracking

Because of the nature of subscription services, it is simple to lose track of how much money you are spending until the invoices begin to accumulate. Because of this, PocketGuard is a useful tool. Keeping track of all of my subscriptions and displaying to me exactly what I am paying for and when each one is set to renew is something that I really appreciate. When it comes to my finances, it’s almost like having a personal assistant.

When you see all of your subscriptions organised in such a manner, it is much simpler to determine whether or not it is worthwhile to keep them. Perhaps you have forgotten that you were paying for a certain service, or perhaps you are not making much use of a service that you have paid for. PocketGuard makes it easier for you to see these things clearly, which enables you to make more informed decisions about how your money is spent.

Bill Negotiation Feature

People do handle their money differently now that PocketGuard offers a bill discussion service. Cutting-edge algorithms and data analysis are used by PocketGuard to look through your bills and find ways for you to save money and make them work better. This method doesn’t just look for chances; it also does something about them, like starting a conversation or suggesting that you move to a cheaper provider.

Imagine that your regular bills went down without you having to do anything. That’s what PocketGuard’s bill peace tool can do. Always having a smart financial advisor work behind the scenes to get you the best deals is like that. Over time, these small but important savings can add up to big amounts. This will help you handle your money better and reach your financial goals faster.

Security and Privacy Measures

It is very important to have top-notch security when dealing with sensitive financial info. We at PocketGuard take this duty very seriously, which is why we use encryption methods that are used by banks. This means that your financial information is encrypted both when it is sent and when it is kept in the databases of our app. This makes it very hard for people who aren’t supposed to have access to see it.

We also offer multi-factor authentication (MFA), which is different from encryption. For this extra layer of protection, you need to prove who you are in two or more ways before you can access your account. For example, you could use a password and a unique code sent to your phone. By having more than one factor for authentication, we make your account much safer and stop people from trying to get in without your permission.

Pricing Plans and Options

I find that PocketGuard has a free basic version that has all the tools I need to manage my money. Some of these are keeping track of spending, making budgets, and setting alerts for bills. PocketGuard does have a Plus version, though, if you want more advanced features. With the Plus version, you can access more features, such as spending categories that you can customise, the ability to join as many accounts as you want, faster customer service, and more information about how you spend your money.

You can choose to pay for PocketGuard Plus either monthly or yearly, so you can pick the payment method that works best for you and your budget. If you choose the Plus version, you can look into your financial information in more detail, improve your budgeting, and get access to paid support services, which will make your experience with the app better overall.

Final Words

Personally, PocketGuard has make it much easier for me to stick to my budget. You can easily handle your money with its simple interface, and it comes with powerful tools for that purpose. PocketGuard has something for everyone, from people who are new to budgeting to people who have been saving for years. The app is a great way to improve your financial health because it focuses on security, in-depth analysis, and proactive savings methods.

If you find this article helpful and informative, consider sharing it with your family and friends on social media platforms such as Facebook and Twitter. Sharing valuable content can benefit others who may also find it useful in their endeavors.

The Good and The Bad

It’s important to think about both the pros and cons of a planning app like PocketGuard when judging it. We’ll talk about the good things about PocketGuard (called “The Good”) that make it a useful financial tool, as well as the bad things that users may find (called “The Bad”).

The Good

- Intuitive interface

- Comprehensive budgeting tools

- Bill tracking and negotiation features

- Spending analysis and insights

- Subscription tracking

- Strong security measures

The Bad

- Some advanced features require subscription

- Limited customization options in free version

Questions and Answers

Is PocketGuard available for both iOS and Android?

There is a version of PocketGuard that is compatible with both iOS and Android smartphones.

Can I connect multiple bank accounts to PocketGuard?

In order to have a comprehensive view of your financial situation, PocketGuard does, in fact, enable you to integrate numerous bank accounts, credit cards, loans, and investments altogether.

Is my financial data secure with PocketGuard?

To ensure the safety of your financial information, PocketGuard places a high priority on security and employs authentication and encryption methods that are industry-standard.

You Might Be Interested In

Leave a Reply