29

Among people who manage their own money, tools like Pocketguard and EveryDollar have become popular because they make budgeting, keeping track of expenses, and making financial goals easier. The goal of this in-depth comparison is to show you their most important features, how easy they are to use, how safe they are, and how much they cost, so you can choose the platform that best meets your needs.

Both Pocketguard and EveryDollar are well-known personal finance management tools that help people stick to their budgets, keep track of their spending, and reach their financial goals. They both has similar goals, but they are different in ways that make them fit the needs of different users and ways of managing money.

Comparison Table

EveryDollar is a planning app that is meant to make managing money easier and encourage smart spending. This part talks about the good things about EveryDollar that make it a good choice for people on a budget, as well as the bad things that might make it less good.

| Criteria | Pocketguard | EveryDollar |

|---|---|---|

| User Interface | Modern and intuitive 🌟 | Simple and straightforward 😊 |

| Budgeting Features | Automated categorization 🔄 | Zero-based budgeting 📊 |

| Expense Tracking | Real-time tracking ⏱️ | Manual input ✍️ |

| Bill Payment Integration | Partially supported 💳 | Not supported ❌ |

| Security Measures | 256-bit encryption, 2FA 🔒 | Secure login 🔐 |

| Pricing | Freemium model with upgrades 💸 | Free version, paid upgrade 💳 |

| Visit website | Visit website |

User Interface and Ease of Use

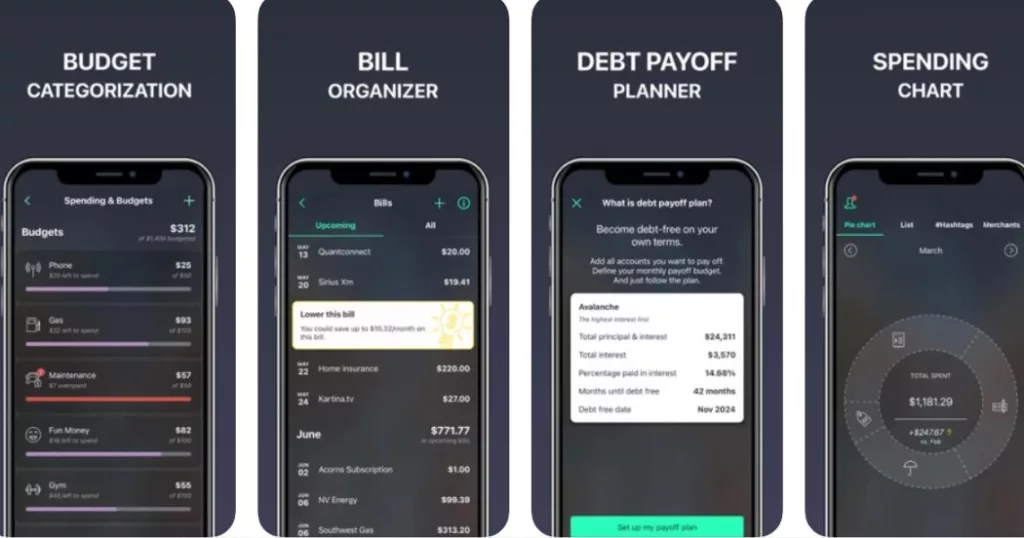

Pocketguard is fun to use because it has a clean, app-focused design that is meant to look good and be simple to understand. Using charts, graphs, and progress bars, it makes my financial information easy to see, so I can quickly understand what’s going on. This style works well for people who are new to managing their money and just want a quick look at their numbers without going into too much depth.

But if you use EveryDollar, you’ll see that it looks like a spreadsheet, which is comfortable for people who normally enter data by hand and make budgets using tables. As with other budgeting methods, this layout gives you a structured way to put your income, expenses, and budget allocations. You might like the spreadsheet-style layout of EveryDollar if you like to do things by hand and like being in charge of what you enter.

Features and Capabilities

When I look at Pocketguard and EveryDollar side by side, I see that each has its own benefits for handling money. Pocketguard stands out because it has powerful bill tracking tools that give you a full picture of your spending. Its ability to find secret fees keeps you up to date on all the fees that come with your bills. Plus, the Plus plan’s help with negotiating bills has helped me get the best deals on my bills.

EveryDollar, on the other hand, is all about planning, which makes it a great choice if managing your money is important to you. The ready-made templates make it simple to start planning right away, and the debt payoff trackers, which are in line with Dave Ramsey’s ideas, give you a structured way to handle your debt and get out of debt. In general, both apps are useful, but which one you choose depends on your cash goals.

Bill Payment and Alerts

When I use Pocketguard, I’ve found that it interfaces with a small set of billers in a smooth manner, which makes it simple to make direct payments directly from within the app. A great deal of convenience is added to the process of handling bills and keeping track of financial commitments by virtue of this function. On the other hand, EveryDollar does not come equipped with a function that allows users to pay their bills automatically.

On the other hand, it makes up for this by enabling users to set reminders from within the application itself. These reminders have been of great use to me in maintaining my organisation and ensuring that I do not miss any payments or deadlines with regard to my obligations. When it comes to properly handling bills and other financial responsibilities, both applications provide a variety of alternative options.

Budgeting and Expense Tracking

Pocketguard is a creative money-management app that has made it easy for me to keep track of my spending and stick to my budget. Putting transactions into groups is a simple process that makes it easy to stay on top of things. Its subscription tracker is one of my favourite features because it helps me keep track of regular costs like memberships and subscriptions.

Everydollar, on the other hand, is more hands-on when it comes to planning, which I like. I get a more accurate and personalised picture of my finances when I enter deals by hand. Everydollar’s zero-based planning method makes sure that every dollar of income goes to a specific goal, so there are no hidden costs. I can make smart choices about where my money goes with this level of control, which also helps me stay on track with my financial goals.

Customer Support and Community Feedback

When it comes to customer service, I have discovered that Pocketguard provides both live chat and email support. This ensures that you may receive prompt assistance through real-time chat as well as more extensive responses via email. On the other hand, EveryDollar offers help via email, but it does not offer a live chat option. This may result in somewhat lengthier response times for questions that are considered to be of less immediate importance.

According to reviews from real users, both Pocketguard and EveryDollar are good options. People often say nice things about Pocketguard’s user-friendly design and how easy it is to use. This makes it a good choice for people who are new to budgeting apps. People have said good things about EveryDollar’s commitment to Dave Ramsey’s ideas. This seems to appeal to people who are looking for a planning tool that fits with Ramsey’s ideas about money.

Security and Privacy Measures

Both Pocketguard and Everydollar care a lot about keeping your data safe, so they use security measures that are standard in the business. Encryption methods are used to keep private data safe. Their servers will keep the data that is sent between your device and their computers safe and unable to be read by people who aren’t supposed to.

For added security, both apps use safe ways to log in, like two-factor authentication (2FA) or tight password rules, to keep your account safe and stop people from getting in without your permission. You can be sure that your financial information is safe when you use these planning apps because they come with security features.

Pricing Models

The free version of Pocketguard has basic tools that are good enough to get you started with good money management. And if you need more advanced tools like making your own categories, keeping track of your bills, and detailed reports, you might want to consider upgrading to their premium plans.

So does EveryDollar. It has a free version with limited features that is great for people who are just starting to budget and want an easy way to keep track of their spending. The free version has simple budgeting tools like tracking expenses and putting them into groups. You’ll have to pay for their paid version, though, if you want tools like automatic bank transaction syncing, custom budget reports, and faster customer service. This update adds more benefits and makes the planning tool more reliable for users who need more than the basics.

How Do You Determine Which Platform Is Best?

It is highly recommended that you go with Pocketguard if you place a high priority on automated spending tracking, detailed budget insights, and advanced security security measures. On the other hand, if you prefer a plain budgeting strategy and don’t require bill payment integration or elaborate security precautions, you could find EveryDollar to be more ideal for you.

If you found this article to be valuable and full of useful information, you might want to consider sharing it with your loved ones on popular social media platforms like Facebook and Twitter. Sharing valuable content can be of great help to others who may also find it useful in their pursuits.

Pocketguard: The Good and The Bad

Pocketguard is a flexible tool for managing personal finances that has both good and bad points. This part goes over what makes Pocketguard a useful tool for people who are watching their budget, along with some things to keep in mind.

The Good

- User-friendly interface with visuals.

- Automated features like bill tracking and categorization.

- Bill negotiation assistance (Plus plan).

The Bad

- Limited bill pay integration.

- Advanced features require a paid subscription.

EveryDollar: The Good and The Bad

EveryDollar is a planning app that is meant to make managing money easier and encourage smart spending. This part talks about the good things about EveryDollar that make it a good choice for people on a budget, as well as the bad things that might make it less good.

The Good

- Free plan with core budgeting features.

- Aligns with Dave Ramsey’s financial principles.

- Encourages zero-based budgeting (envelope method).

The Bad

- Lacks automated features and requires manual entry.

- No bill pay functionality.

Questions and Answers

Is Pocketguard or Everydollar more secure?

When it comes to protecting user data, Pocketguard and Everydollar both use security procedures that are considered to be industry standards.

Can I use Pocketguard and Everydollar together?

Even though it is feasible, it can be unnecessary. Think about which software provides the functions that are most pertinent to your requirements for making a budget.

Are there any free alternatives to Pocketguard and Everydollar?

A few of budgeting apps do, in fact, provide free tiers that include essential functions. Make use of services such as Mint (before it goes out of business in March 2024) or YNAB to locate the one that is most suitable for your needs.

You Might Be Interested In

Leave a Reply