33

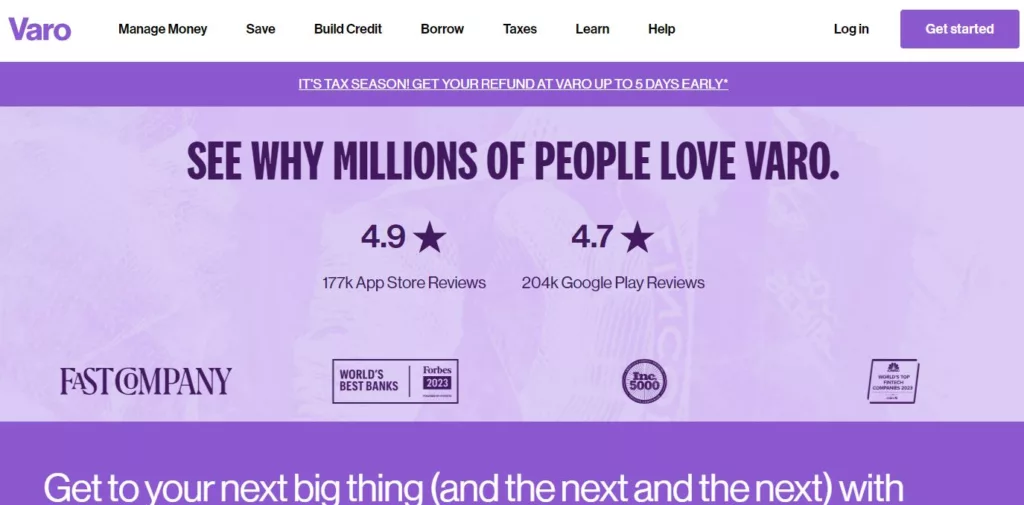

Varo have been a standout digital-first bank in my experience with modern banking. They offer a wide range of services that are suited to my needs as a customer. This Varo review will go over its features, user design, security measures, account types, and more to help you choose the best bank for your needs.

In my opinion, Varo Bank is one of the best digital banks because it offers a wide range of modern banking services. I think one of the best things about it is how easy it is to use, which makes handling money a breeze. Varo’s interface is easy to use and can be accessed on any device, whether you’re checking your balance, transferring money, or paying fees.

Varo review: Feature Table

When thinking about a banking platform like Varo, it’s important to know what its main benefits are. This table of features gives you a quick look at what Varo has to offer, from easy mobile banking to unique financial tools, so you can decide if it fits your banking needs.

| Feature | Description |

|---|---|

| Account Types | Checking and Savings Accounts 🏦 |

| Monthly Fees | None 🚫 |

| Minimum Balance | None ⚖️ |

| ATM Network | Over 40,000 Allpoint ATMs surcharge-free 🏧 |

| Cash Deposit Options | Green Dot network at retail locations (fees apply) 💵 |

| Mobile App | User-friendly app available for iOS and Android 📱 |

| Security Features | Fingerprint or facial recognition login, transaction alerts 🔐 |

| Overdraft Protection | Varo Advance (up to $250, subject to eligibility) 💸 |

| Visit website |

What is Varo?

Varo gives a mobile banking platform with a full range of financial services that meet the needs of modern bankers. We offers checking and savings accounts with lots of features that are meant to help you better handle your money. Varo gives you access to simple tools and information that help you make smarter choices about your money and reach your money management goals more quickly.

One of the main reasons I’ve been successful with Varo is that it has an easy-to-use design that makes banking quick and simple. Every part of Varo is designed to be easy for people to use. This makes things like checking balances, transferring money, and paying fees not only simple but also fun.

When I log in to Varo, I see a screen that is clean and well-organized. It shows me all the important information quickly. The balance of my account, recent transactions, and future bills are all easy to see, so I can quickly understand my financial situation.

Varo review: Account Types

When it came to money, we at Varo are aware that everyone has a unique set of requirements. Because of this, we provide a variety of account types that are tailored to meet the individual requirements of your lifestyle and aspirations. There is a suitable account for you at Varo, regardless of whether you are primarily concerned with saving for long-term goals, saving for day-to-day expenses, or a combination of the two.

The ability to make early direct deposits is one of the most distinguishing characteristics of Varo. This indicates that you will be able to obtain access to your paycheck up to two days earlier than usual, which will provide you with increased control over your finances and enable you to confidently plan ahead.

Varo review: Security Measures

.. In order to lessen the risk that sensitive information may be accessed by unauthorised parties, we encrypt data not only while it is being sent but also while it is being stored. This is done with the use of advanced encryption algorithms. In addition, we make use of multi-factor authentication (MFA) technologies, which, in addition to the password that you use to access your account, provide an extra layer of security for your account.

This proactive approach to security helps defend against prospective threats and helps shield against potential dangers. In addition to improving the overall safety of your financial transactions with Varo, this strategy also helps protect against potential challenges.

Varo review: How to Open an Account

Setting up an account with Varo is easy, and you can do it all through the mobile app. Downloading the app, entering the required information, and following the on-screen steps were all I had to do to make an account.

It is easy to make an account with Varo. You will be able to easily complete the process with the Varo mobile app, which only needs basic information like your Social Security number and a legal ID card. Because the platform is easy to use and has a simple layout, setting up your account will be quick and easy. After you finish the process, you’ll be able to use a lot of different banking features and services right away.

Varo review: Impact on Personal Finance Management

When we use Varo, our full set of budgeting tools and spending details built right into the app give us powerful tools to take charge of our money. We can easily set financial goals that are specific to our needs, keep a close eye on our spending, and get alerts at the right time that help us stay aware and take charge of our financial health. These features give us the information we need to make smart choices, spend our money wisely, and eventually become more financially stable and successful.

Using Varo’s budgeting tools, we can divide our spending into categories and allocate funds properly. This way, we can make sure we don’t go over our budget and spend too much. The app’s easy-to-use interface lets us see our financial information in graphs and charts that are simple to understand. This makes it simple to spot spending trends and places where we can save money or move it around.

Varo review: Mobile Banking Experience

I have found that the mobile app that is easy to use is not merely a feature, but rather the core essence of my experience with Varo banking. My ability to effortlessly take care of my finances, regardless of where I am, is made possible by its user-friendly interface and seamless navigation, both of which were designed with a strong emphasis on user convenience.

Whether I need to check the amount of my account, transfer funds, pay bills or keep track of my expenses, the Varo app provides me with a full range of options that are right at my fingertips. I can rely on it to be a trustworthy friend for managing my financial life while I am on the move because of its responsive design, which guarantees a smooth experience across a variety of devices.

Varo review: Customer Support and Service

During regular business hours, I make use of both the phone and chat alternatives that Varo has for its customer support services. This has provided me with the opportunity to interact with the company’s customer support services.

Although there were instances in which I was required to wait for a short period of time, on the whole, I have discovered that the customer care team at Varo is pretty helpful and that they answer quickly. Their timely and effective assistance with a variety of account-related inquiries has been consistent throughout my interactions with them. In addition, anytime I required additional clarification, their responses were usually crystal clear and covered a lot of ground.

Final Words

As a conclusion, I have come to the opinion that Varo provides a comprehensive range of financial services with an emphasis on user experience, convenience, and security. There are some areas that may be improved, such as expanding the network of automated teller machines (ATMs), but Varo continues to be a good option for people who are looking for modern banking solutions.

Feel free to share this post on Facebook and Twitter if you think it was a good read and could be of use to your friends and family. The act of sharing something of value increases the likelihood that other people will find it useful for their own purposes.

Varo review: The Good and The Bad

Varo has some good features and some things that could be better in the constantly changing world of digital payments. In this part of the Varo review, the pros and cons of using Varo as your bank are broken down, showing its strengths and areas where it could improve the user experience.

The Good

- Free checking and savings accounts with no monthly fees

- Competitive interest rates on savings accounts

- Early access to direct deposits

- User-friendly mobile app

The Bad

- No physical branches

- Limited cash deposit options (fees apply)

- Interest rates on savings accounts can change

Questions and Answers

Can I open both a checking and savings account with Varo?

Yes, users can choose between checking and high-yield savings accounts when they open an account with Varo.

Is Varo’s mobile app available for both iOS and Android?

It is true that the mobile app for Varo is compatible with both iOS and Android versions of mobile devices.

How does Varo’s early direct deposit feature work?

In the event that you have set up direct deposit with your company, Varo will enable you to receive your paycheck up to two days earlier than usual.

You Might Be Interested In

Leave a Reply